Learning Module 1: Intercorporate Investments

- Describe the classification, measurement, and disclosure under International Financial Reporting Standards (IFRS) for 1) investments in financial assets, 2) investments in associates, 3) joint ventures, 4) business combinations, and 5) special purpose and variable interest entities

- Compare and contrast IFRS and US GAAP in their classification, measurement, and disclosure of investments in financial assets, investments in associates, joint ventures, business combinations, and special purpose and variable interest entities

- Analyze how different methods used to account f or intercorporate investments affect financial statements and ratios

Basic corporate investment categories

1.1 Describe the classification, measurement, and disclosure under International Financial Reporting Standards (IFRS) for 1) investments in financial assets, 2) investments in associates, 3) joint ventures, 4) business combinations, and 5) special purpose and variable interest entities

1.2 Compare and contrast IFRS and US GAAP in their classification, measurement, and disclosure of investments in financial assets, investments in associates, joint ventures, business combinations, and special purpose and variable interest entities

1.3 Analyze how different methods used to account f or intercorporate investments affect financial statements and ratios

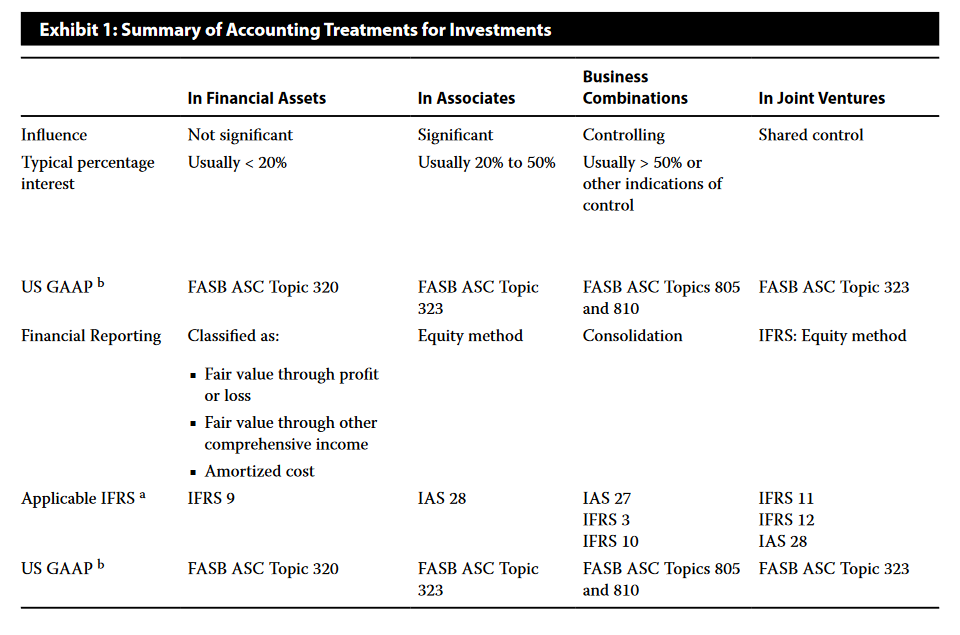

The International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) worked to reduce differences in accounting standards that apply to the classification, measurement, and disclosure of intercorporate investments. IFRS (International Financial Reporting Standards) accounting standards and US GAAP

- (1) investments in financial assets in which the investor has no significant influence or control over the operations of the investee (Holding < 25%)

- (2) investments in associates in which the investor can exert significant influence (but not control) over the investee (50% > Holding > 25%)

- (3) joint ventures where control is shared by two or more entities (Shared Control)

- (4) business combinations, including investments in subsidiaries, in which the investor obtains a controlling interest over the investee (Holding > 50%).

Investment in financial assets: IFRS 9

- The IASB issued the first phase of their project dealing with classification and measurement of financial instruments by including relevant chapters in IFRS 9, Financial Instruments. IFRS 9, which replaces IAS 39, became effective for annual periods on 1 January 2018.

- The FASB’s guidance relating to the accounting for investments in financial instruments is contained in ASC 825, Financial Instruments, which has been updated several times, with the standard being effective for periods after 15 December 2017.

When to use amortized cost and some recent updates

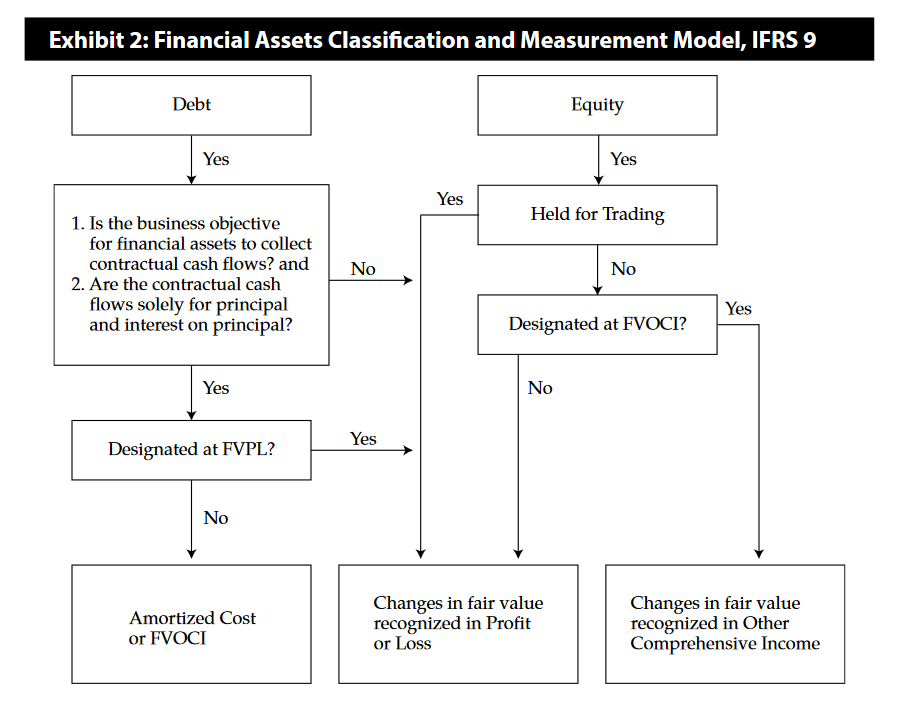

- IFRS 9 is based on an approach that considers the contractual characteristics of cash flows as well as the management of the financial assets. The portfolio approach of the previous standard (i.e., designation of held for trading, available-for-sale, and held-to-maturity) is no longer appropriate, and the terms available-for-sale and held-to-maturity no longer appear in IFRS 9.

- Another key change in IFRS 9, compared with IAS 39, relates to the approach to loan impairment. In particular, companies are required to migrate from an incurred loss model to an expected credit loss model. This results in companies evaluating not only historical and current information about loan performance, but also forward-looking information.

- The criteria for using amortized cost are similar to those of the IAS 39 “management intent to hold-to-maturity” classification. Specifically, to be measured at amortized cost, financial assets must meet two criteria:

- A business model test: The financial assets are being held to collect contractual cash flows; and

- A cash flow characteristic test: The contractual cash flows are solely payments of principal and interest on principal.

Classification and Measurement

IFRS 9 divides all financial assets into two classifications—measured at amortized cost and at fair value. Under this approach, there are three different categories of measurement:

- Amortized Cost: The amortized cost method is used to measure financial assets that the company plans to hold until maturity, primarily to collect contractual cash flows. The cash flows of such assets should consist of fixed or determinable payments (such as interest and principal) based on historical cost. Interest income and impairment losses are recognized in the current profit or loss, while fair value fluctuations do not impact the current profit or loss.

- Fair Value Through Profit or Loss (FVPL): The FVPL method applies to financial assets held for trading purposes or those that do not meet the conditions for amortized cost or FVOCI. All fair value changes, including interest and dividend income, are directly recognized in the current profit or loss.

- Fair Value Through Other Comprehensive Income (FVOCI): The FVOCI method is used for financial assets that collect contractual cash flows but may also be sold. Such assets typically have fixed income payments, allowing the holder to collect contractual cash flows while potentially selling the asset at an appropriate time. Fair value changes are recognized in Other Comprehensive Income (OCI) rather than the current profit or loss, while interest income, impairment losses, and foreign exchange differences are recognized in the current profit or loss.

Amortized Cost VS Fair Value

- Amortized Cost is used when the asset is intended to generate predictable cash flows from interest and principal payments over time. This method aligns with assets held to maturity, where changes in market price are less relevant because the company doesn’t plan to sell the asset.

- Fair Value reflects the current market value of an asset, which is relevant for assets that are held for trading or could be sold before maturity. This method captures real-time changes in market prices, which is essential for assets actively managed with buying and selling in mind.

- Example: A bank’s long-term customer loans are often measured at amortized cost because they are held to collect interest and principal, not to be sold based on fluctuating market prices. In contrast, a portfolio of publicly traded equity shares would be measured at fair value as they are likely to be traded.

- Amortized Cost(摊余成本)

- 银行贷款: 假设一家银行向客户发放了一笔5年期贷款,利率为4%,计划持有至到期收取利息和本金。这笔贷款将以摊余成本记录。每年,银行会使用 有效利率法(effective interest method)确认利息收入,并将贷款初始金额扣除还款和减值后作为资产负债表中的账面价值。

- 在资产负债表: 贷款按摊余成本列示,例如,在“贷款和应收款”科目下显示为 1,000,000 美元。

- 在损益表: 每年确认利息收入,例如,第一年为 40,000 美元,计入“财务收入” (finance income and expenses)。

- 公司发行的企业债券: 假设一家公司购买了一笔债券,票面利率为6%,期限为10年,打算持有至到期。公司将以摊余成本记录这笔债券,通过扣除初始成本与溢价或折价调整,确认每年收入而不会受市场波动影响。

- 在资产负债表: 债券价值会随着折价或溢价的摊销而调整。

- 在损益表: 公司确认按有效利率法计算的利息收入。

- 银行贷款: 假设一家银行向客户发放了一笔5年期贷款,利率为4%,计划持有至到期收取利息和本金。这笔贷款将以摊余成本记录。每年,银行会使用 有效利率法(effective interest method)确认利息收入,并将贷款初始金额扣除还款和减值后作为资产负债表中的账面价值。

- Fair Value(公允价值)

- 交易性金融资产: 比如,一家公司购买了一些上市股票,希望在短期内出售以获取利润。由于这些股票的市场价格波动频繁,公司会以公允价值计量,通过盈余或亏损反映在损益表中。即使公司并没有出售股票,也会在每个报告期按照市场价格重新计量。

- 在资产负债表: 股票按市场价格记录在“以公允价值计量且其变动计入当期损益的金融资产”项下。

- 在损益表: 因价格波动产生的未实现收益或亏损直接反映在“投资收益”或“其他收入”项下。

- 公司投资的可供出售债券: 假设一家公司购买了一批政府债券,并且打算在未来市场利率上升时出售。这些债券在初始时以公允价值入账,并且每期都会根据市场波动重新计量,但公允价值变动不会立即影响损益表,而是反映在其他综合收益(OCI)中。若未来公司出售债券,累计的公允价值变动会转移至损益表。

- 交易性金融资产: 比如,一家公司购买了一些上市股票,希望在短期内出售以获取利润。由于这些股票的市场价格波动频繁,公司会以公允价值计量,通过盈余或亏损反映在损益表中。即使公司并没有出售股票,也会在每个报告期按照市场价格重新计量。

All financial assets are measured at fair value when initially acquired (which will generally be equal to the cost basis on the date of acquisition). Subsequently, financial assets that meet the two criteria above (business model test and cash flow characteristic test) are generally measured at amortized cost. If the financial asset meets the criteria above but may be sold, a “hold-to-collect and sell” business model, it may be measured at fair value through other comprehensive income (FVOCI). However, management may choose the “fair value through profit or loss” (FVPL) option to avoid an accounting mismatch.

An “accounting mismatch” refers to an inconsistency resulting from different measurement bases for assets and liabilities, i.e., some are measured at amortized cost and some at fair value.

- Debt instruments are measured at amortized cost, fair value through other comprehensive income (FVOCI), or fair value through profit or loss (FVPL) depending upon the business model.

- Equity instruments are measured at FVPL or at FVOCI; they are not eligible for measurement at amortized cost. Equity investments held-for-trading must be measured at FVPL. Other equity investments can be measured at FVPL or FVOCI; however, the choice is irrevocable. If the entity uses the FVOCI option, only the dividend income is recognized in profit or loss. Furthermore, the requirements for reclassifying gains or losses recognized in other comprehensive income are different for debt and equity instruments.

- Derivatives are measured at FVPL (except for hedging instruments). Embedded derivatives are not separated from the hybrid contract if the asset falls within the scope of this standard and the asset as a whole is measured at FVPL.

Reclassification of Investments

- Under IFRS 9, the reclassification of equity instruments is not permitted because an entity’s initial classification of FVPL and FVOCI is irrevocable.

- Reclassification of debt instruments is only permitted if the business model for the financial assets (objective for holding the financial assets) has changed in a way that significantly affects operations.

- When reclassification is deemed appropriate, there is no restatement of prior periods at the reclassification date.

- For example, if the financial asset is reclassified from amortized cost to FVPL, the asset is then measured at fair value with any gain or loss immediately recognized in profit or loss. If the financial asset is reclassified from FVPL to amortized cost, the fair value at the reclassification date becomes the carrying amount.

Summary of major changes made by IFRS 9:

- A business model approach to classification of debt instruments.

- Three classifications for financial assets:

- Fair value through profit or loss (FVPL),

- fair value through other comprehensive income (FVOCI), and

- amortized cost.

- Reclassifications of debt instruments are permitted only when the business model changes. The choice to measure equity investments at FVOCI or FVPL is irrevocable.

- A redesign of the provisioning models for financial assets, financial guarantees, loan commitments, and lease receivables. The new standard moves the recognition criteria from an “incurred loss” model to an “expected loss” model. Under the new criteria, there is an earlier recognition of impairment—12 month expected losses for performing assets and lifetime expected losses for non-performing assets, to be captured upfront.

Analysts typically evaluate performance separately for operating and investing activities. Analysis of operating performance should exclude items related to investing activities such as interest income, dividends, and realized and unrealized gains and losses. For comparative purposes, analysts should exclude non-operating assets in the determination of return on net operating assets.

Investment in associates, joint ventures

- Under both IFRS and US GAAP, when a company (investor) holds 20 to 50% of the voting rights of an associate (investee)

- IFRS identify the following common characteristics of joint ventures: 1) A contractual arrangement exists between two or more venturers, and 2) the contractual arrangement establishes joint control.

- Both IFRS and US GAAP require the equity method of accounting for joint ventures and associate.

Equity Method of Accounting: Basic Principles

- Under the equity method of accounting, the equity investment is initially recorded on the investor’s balance sheet at cost.

- In subsequent periods, the carrying amount of the investment is adjusted to recognize the investor’s proportionate share of the investee’s earnings or losses, and these earnings or losses are reported in income.

- Dividends or other distributions received from the investee are treated as a return of capital and reduce the carrying amount of the investment and are not reported in the investor’s profit or loss.

- The equity method is often referred to as “one-line consolidation” because the investor’s proportionate ownership interest in the assets and liabilities of the investee is disclosed as a single line item (net assets) on its balance sheet, and the investor’s share of the revenues and expenses of the investee is disclosed as a single line item on its income statement.

- Equity method investments are classified as non-current assets on the balance sheet. The investor’s share of the profit or loss of equity method investments, and the carrying amount of those investments, must be separately disclosed on the income statement and balance sheet.

Amortization of Excess Purchase Price, Fair value Option, and Impairment

- The cost (purchase price) to acquire shares of an investee is often greater than the book value of those shares. This is because, among other things, many of the investee’s assets and liabilities reflect historical cost rather than fair value.

- IFRS allow a company to measure its property, plant, and equipment using either historical cost or fair value (less accumulated depreciation).

- US GAAP, however, require the use of historical cost (less accumulated depreciation) to measure property, plant, and equipment.

- Excess purchase price = Pirce (Cost) – book value of net assets

- When the cost of the investment exceeds the investor’s proportionate share of the book value of the investee’s (associate’s) net identifiable tangible and intangible assets (e.g., inventory, property, plant and equipment, trademarks, patents), the difference is first allocated to specific assets (or categories of assets) using fair values. These differences are then amortized to the investor’s proportionate share of the investee’s profit or loss over the economic lives of the assets whose fair values exceeded book values.

- IFRS and US GAAP both treat the difference between the cost of the acquisition and difference between the fair value and book value of the net identifiable assets as goodwill.

- goodwill is the residual excess not allocated to identifiable assets or liabilities.

- Goodwill is not amortized. Instead, it is reviewed for impairment on a regular basis, and written down for any identified impairment.

- Goodwill, however, is included in the carrying amount of the investment, because investment is reported as a single line item on the investor’s balance sheet.

- Fair Value Option: Both IFRS and US GAAP give the investor the option to account for their equity method investment at fair value. Under US GAAP, this option is available to all entities; however, under IFRS, its use is restricted to venture capital organizations, mutual funds, unit trusts, and similar entities, including investment-linked insurance funds.

- Equity Method of Accounting:权益法适用于持股比例能显著影响被投资方的企业(通常持股20%-50%),投资方按其持股比例确认其应占的被投资方利润、损失及权益变动。因此,权益法反映了投资方在被投资方的“权益份额”。The equity method is named for how it reflects the investor’s proportional equity (ownership) in the investee company on the investor’s financial statements.

- Fair Value Option:FVO适用于希望按市场价格反映投资的企业,尤其是那些投资频繁变动且无法或无需显著影响被投资方的投资者。公允价值波动及分红会直接计入损益,而无需按持股比例确认被投资方的损益份额。

- Impairment: Both IFRS and US GAAP require periodic reviews of equity method investments for impairment. If the fair value of the investment is below its carrying value and this decline is deemed to be other than temporary, an impairment loss must be recognized. 在国际财务报告准则 (IFRS) 和美国公认会计准则 (US GAAP) 下,Goodwill(商誉)通常不会被摊销

When we say “the building was undervalued by €40,000”, it means that on the acquisition date (1 January 2018), the fair value of the building owned by Foxworth Company was €40,000 higher than its book value (the value recorded on Foxworth’s balance sheet).

Transcations with associates and disclosure

- Because an investor company can influence the terms and timing of transactions with its associates, profits from such transactions cannot be realized until confirmed through use or sale to third parties (we need exclude unrealized earning when calculating equity income). Accordingly, the investor company’s share of any unrealized profit must be deferred by reducing the amount recorded under the equity method. In the subsequent period(s) when this deferred profit is considered confirmed, it is added to the equity income. At that time, the equity income is again based on the recorded values in the associate’s accounts.

- Transactions between the two affiliates may be upstream (associate to investor) or downstream (investor to associate).

- Upstream sale, the profit on the intercompany transaction is recorded on the associate’s income (profit or loss) statement. The investor’s share of the unrealized profit is thus included in equity income on the investor’s income statement.

- Downstream sale, the profit is recorded on the investor’s income statement.

M&A, Consolidation, and Special Purpose or Variable Interest Entities

- Merger: Company A + Company B = Company A

- Acquisition: Company A + Company B = (Company A + Company B)

- Consolidation: Company A + Company B = Company C

- Special Purpose or Variable Interest Entities

- IFRS and US GAAP require the acquisition method of accounting for business combinations, although both have a few specific exemptions.

Acquisition Method of Accounting

- Under this approach, the fair value of the consideration given by the acquiring company is the appropriate measurement for acquisitions and also includes the acquisition-date fair value of any contingent consideration. Direct costs of the business combination, such as professional and legal fees, valuation experts, and consultants, are expensed as incurred.

- Recognition and Measurement of Identifiable Assets and Liabilities

- IFRS and US GAAP require that the acquirer measure the identifiable tangible and intangible assets and liabilities of the acquiree (acquired entity) at fair value as of the date of the acquisition.

- The acquirer must also recognize any assets and liabilities that the acquiree had not previously recognized as assets and liabilities in its financial statements. For example, identifiable intangible assets (for example, brand names, patents, technology) that the acquiree developed internally would be recognized by the acquirer.

- Recognition and Measurement of Contingent Liabilities

- IFRS include contingent liabilities if their fair values can be reliably measured.

- US GAAP includes only those contingent liabilities that are probable and can be reasonably estimated.

- Recognition and Measurement of Indemnification Assets

- On the acquisition date, the acquirer must recognize an indemnification asset if the seller (acquiree) contractually indemnifies the acquirer for the outcome of a contingency or an uncertainty related to all or part of a specific asset or liability of the acquiree.

- The seller may also indemnify the acquirer against losses above a specified amount on a liability arising from a particular contingency.

- For example, the seller guarantees that an acquired contingent liability will not exceed a specified amount.

- Recognition and Measurement of Financial Assets and Liabilities

- At the acquisition date, identifiable assets and liabilities acquired are classified in accordance with IFRS (or US GAAP) standards.

- Recognition and Measurement of Goodwill

- “Partial goodwill” is measured as the fair value of the acquisition (fair value of consideration given) less the acquirer’s share of the fair value of all identifiable tangible and intangible assets, liabilities, and contingent liabilities acquired.

- “Full goodwill” is measured as the fair value of the entity as a whole less the fair value of all identifiable tangible and intangible assets, liabilities, and contingent liabilities. US GAAP views the entity as a whole and requires full goodwill.

- Recognition and Measurement when Acquisition Price Is Less than Fair Value

- Occasionally, a company faces adverse circumstances such that its market value drops below the fair value of its net assets. In an acquisition of such a company, where the purchase price is less than the fair value of the target’s (acquiree’s) net assets, the acquisition is considered to be a “bargain purchase” acquisition. IFRS and US GAAP require the difference between the fair value of the acquired net assets and the purchase price to be recognized immediately as a gain in profit or loss.

Impact of the Acquisition Method on Financial Statements, Post-Acquisition

Acquisition Method Post-Combination Balance Sheet:

- (Post-Combined) Asset = Book Value of Company A + Market Value of Company B (Target Company)

- The excess pruchase price which cannot be allocated to identifiable net assets is Goodwill

The Consolidation Process

- Non-controlling interests under full-goodwill is 10% of (let’s assume acquire 90% of target company) market price of Company B

- Non-controlling interests under partial-goodwill is 10% of (let’s assume acquire 90% of target company) fair value of identifiable net asset of Company B

Goodwill Impairment

- IFRS: Impairment loss = Carrying amount of unit – Recoverable amount of unit

- US GAAP:

- Step 1 – Determination of an Impairment Loss

- Step 2 – Measurement of the Impairment Loss

Special purpose entities (SPEs)

- SPEs are enterprises that are created to accommodate specific needs of the sponsoring entity.

- The primary beneficiary of a variable interest entity (VIE) must consolidate it as a subsidiary regardless of how much of an equity investment the beneficiary has in the VIE.

Additional issues in business combinations that impair comparability

- Contingent Assets and Liabilities

- Under IFRS, the cost of an acquisition is allocated to the fair value of assets, liabilities, and contingent liabilities. Contingent liabilities are recorded separately as part of the cost allocation process, provided that their fair values can be measured reliably.

- Under US GAAP, contractual contingent assets and liabilities are recognized and recorded at their fair values at the time of acquisition.

- Contingent Consideration

- Contingent consideration may be negotiated as part of the acquisition price.

- Under both IFRS and US GAAP, contingent consideration is initially measured at fair value. IFRS and US GAAP classify contingent consideration as an asset, liability or equity. In subsequent periods, changes in the fair value of liabilities (and assets, in the case of US GAAP) are recognized in the consolidated income statement. Both IFRS and US GAAP do not remeasure equity classified contingent consideration; instead, settlement is accounted for within equity.

- In-Process R&D

- IFRS and US GAAP recognize in-process research and development acquired in a business combination as a separate intangible asset and measure it at fair value (if it can be measured reliably).

- Restructuring Costs

- IFRS and US GAAP do not recognize restructuring costs that are associated with the business combination as part of the cost of the acquisition. Instead, they are recognized as an expense in the periods the restructuring costs are incurred.