Learning Module 1: Currency Exchange Rates: Understanding Equilibrium Value

- Calculate and interpret the bid–offer spread on a spot or forward currency quotation and describe the factors that affect the bid–offer spread

- Identify a triangular arbitrage opportunity and calculate its profit, given the bid–offer quotations for three currencies

- Explain spot and forward rates and calculate the forward premium/discount for a given currency

- Calculate the mark-to-market value of a forward contract

- Explain international parity conditions (covered and uncovered interest rate parity, forward rate parity, purchasing power parity, and the international Fisher effect)

- Describe relations among the international parity conditions

- Evaluate the use of the current spot rate, the forward rate, purchasing power parity, and uncovered interest parity to forecast future spot exchange rates

- Explain approaches to assessing the long-run fair value of an exchange rate

- Describe the carry trade and its relation to uncovered interest rate parity and calculate the profit from a carry trade

- Explain how flows in the balance of payment accounts affect currency exchange rates

- Explain the potential effects of monetary and fiscal policy on exchange rates

- Describe objectives of central bank or government intervention and capital controls and describe the effectiveness of intervention and capital controls

- Describe warning signs of a currency crisis

What is exchange rate? Forreign exchange market concepts

1.1 Calculate and interpret the bid–offer spread on a spot or forward currency quotation and describe the factors that affect the bid–offer spread

- An exchange rate is the price of the base currency expressed in terms of the price currency, or example, a USD/EUR rate of 1.1650 means the euro, the base currency, costs 1.1650 US dollars

- Notions: Notation is generally not standardized in global foreign exchange markets, and there are several common ways of expressing the same currency pair (e.g., JPY/ USD, USD:JPY, $/¥). What is common in FX markets, however, is the concept of a “base” and a “price” currency when setting exchange rates. We will sometimes switch to discussing a “domestic” and a “foreign” currency, quoted as foreign/ domestic (f/d). Currency pairs are not described in terms of “foreign” and “domestic” currencies in professional FX markets (may lead confusions).

- The spot exchange rate is usually used for settlement on the second business day after the trade date, referred to as T + 2 settlement (the exception being CAD/USD, for which standard spot settlement is T + 1)

- Bid-offer price: In foreign exchange markets—as in other financial markets—market participants are presented with a two-sided price in the form of a bid price and an offer price (also called an ask price) quoted by potential counterparties. The bid price is the price, defined in terms of the price currency, at which the counterparty is willing to buy one unit of the base currency. Similarly, the offer price is the price, in terms of the price currency, at which that counterparty is willing to sell one unit of the base currency.

- For example, given a price request from a client, a dealer might quote a two-sided price on the spot USD/EUR exchange rate of 1.1648/1.1652. This means that the dealer is willing to pay USD 1.1648 to buy one EUR and that the dealer is willing to sell one EUR for USD 1.1652.

- The offer price is always higher than the bid price.

- The party in the transaction who requests a two-sided price quote has the option (but not the obligation) to deal at either the bid (to sell the base currency) or the offer (to buy the base currency) quoted by the dealer.

- Most currencies, except for the yen, are quoted to four decimal places. The fourth decimal place (0.0001) is referred to as a “pip.” The yen is typically quoted to just two decimal places; in yen quotes, the second decimal place (0.01) is referred to as a pip.

Bid–offer pricing from dealers

- The bid–offer spread a dealer provides to most clients typically is slightly wider than the bid–offer spread observed in the interbank market.

- For example, if the quote in the interbank USD/EUR spot market is 1.1649/1.1651 (two pips wide), the dealer might quote a client a bid–offer of 1.1648/1.1652 (four pips wide) for a spot USD/EUR transaction. When the dealer buys (sells) the base currency from (to) a client, the dealer is typically expecting to quickly turn around and sell (buy) the base currency in the interbank market.

- The size of this spread depends primarily on three factors:

- the bid–offer spread in the interbank foreign exchange market for the two currencies involved.

- the size of the transaction.

- The size of a transaction can also influence the bid-offer spread given by a dealer. Generally, larger transactions lead to prices further from the current spot exchange rate. For example, a client requesting a spot CAD/USD price for USD 50 million will see a wider spread than one asking for USD 1 million. This wider spread reflects the dealer’s increased difficulty in managing the FX risk in the interbank market.

- Smaller transactions can also impact the spread. “Retail” quotes, for amounts below 1 million units, including individual trades, often have much larger spreads compared to those in the interbank market.

- the relationship between the dealer and the client.

- The relationship between the dealer and client can affect the bid-offer spread. Spot FX is often just one of many services the dealer offers, like bond or equity trades. To win more business, the dealer may offer a tighter spread. Dealers may also tighten spreads to get repeat FX business. Credit risk can affect the spread too, with higher risk clients getting wider spreads. However, since spot FX settles quickly (usually in two days), credit risk is less important in deciding the spread.

Bid–offer pricing from interbanks

- The size of the bid–offer spread quoted in the interbank market depends on the liquidity in this market.

- The currency pair involved. Liquidity in the major currency pairs—for example, USD/EUR, JPY/USD, and USD/GBP—can be quite high. These markets are almost always deep, with multiple bids and offers from market participants around the world. In other currency pairs, particularly some of the more obscure currency cross rates (e.g., MXN/CHF), market participation is much thinner and consequently the bid–offer spread in the interbank market will be wider.

- The time of day. The interbank FX markets are most liquid when the major FX trading centers are open. Business hours in London and New York—the two largest FX trading centers—overlap from approximately 8:00 a.m. to 11:00 a.m. New York time. and 13:00 to 16:00 London time The interbank FX market for most currency pairs is typically most liquid during these hours.

- Market volatility. As in any financial market, when major market participants have greater uncertainty about the factors influencing market pricing, they will attempt to reduce their risk exposures and/or charge a higher price for taking on risk. In the FX market, this response implies wider bid–offer spreads in both the interbank and broader markets. Geopolitical events (e.g., war, civil strife), market crashes, and major data releases (e.g., US non-farm payrolls) are among the factors that influence spreads and liquidity.

Arbitrage constraints on spot exchange rate quotes

1.2 Identify a triangular arbitrage opportunity and calculate its profit, given the bid–offer quotations for three currencies

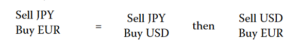

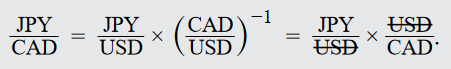

Triangular arbitrage

The bid–offer quotes a dealer shows in the interbank FX market must respect two arbitrage constraints; otherwise the dealer creates riskless arbitrage opportunities for other interbank market participants.

- First, the bid shown by a dealer in the interbank market cannot be higher than the current interbank offer, and the offer shown by a dealer cannot be lower than the current interbank bid.

- Second, the cross-rate bids (offers) posted by a dealer must be lower (higher) than the implied cross-rate offers (bids) available in the interbank market.

- For example, given exchange rate quotes for the currency pairs A/B and C/B, we can back out the implied cross rate of A/C. This implied A/C cross rate must be consistent with the A/B and C/B rates.

Forward markets

1.3 Explain spot and forward rates and calculate the forward premium/ discount for a given currency

Forwards contracts A

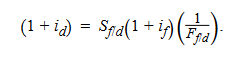

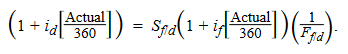

Any exchange rate transaction that has a settlement date longer than T + 2 is a forward contract. Intuition behind forward rate: Investment in risk-free asset should have same return in domestic and foregin countries. Consider an investor with one unit of domestic currency to invest for one year. The investor faces two alternatives:

- One alternative is to invest cash for one year at the domestic risk-free rate (id). At the end of the year, the investment would be worth (1 + id).

- The other alternative is to convert the domestic currency to foreign currency at the spot rate of Sf/d and invest for one year at the foreign risk-free rate (if). At the end of the period, the investor would have Sf/d(1 + if) units of foreign currency. These funds then must be converted back to the investor’s domestic currency. If the exchange rate to be used for this end-of-year conversion is set at the start of the period using a one-year forward contract, then the investor will have eliminated the foreign exchange risk associated with converting at an unknown future spot rate. If we let Ff/d denote the forward rate, the investor would obtain (1/Ff/d) units of the domestic currency for each unit of foreign currency sold forward. Hence, in domestic currency, at the end of the year, the investment would be worth Sf/d(1 + if)(1/Ff/d).

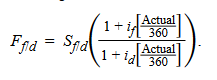

The risk-free assets used in this arbitrage relationship are typically bank deposits quoted using the appropriate Market Reference Rate for each currency involved. The day count convention MRR deposits may be Actual/360 or Actual/365. The main exception to the Actual/360 day count convention is the GBP, for which the convention is Actual/365.

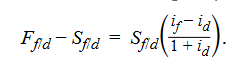

It can be rearranged to:

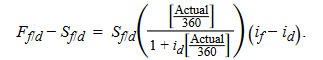

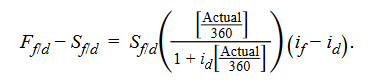

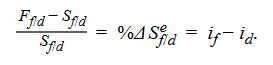

This is covered interest rate parity equation, and it can also be rearranged to give an expression for the forward premium or discount:

The domestic currency will trade at a forward premium (Ff/d > Sf/d) if, and only if, the foreign risk-free interest rate exceeds the domestic risk-free interest rate (if > id). It can also be rewrited as

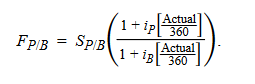

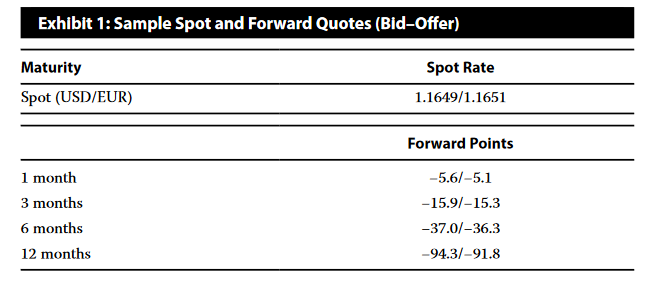

Forwards contracts B: Case of forwards contracts:

- To convert any of these quoted forward points into a forward rate, divide the number of points by 10,000 (to scale it down to the same four decimal places in the USD/ EUR spot quote) and then add the result to the spot exchange rate quote (because the JPY/USD exchange rate is quoted to only two decimal places, forward points for the dollar–yen currency pair are divided by 100).

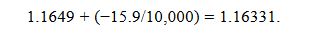

- Be careful, however, about which side of the market (bid or offer) is being quoted. For example, suppose a market participant is selling the EUR forward against the USD and is given a USD/EUR quote. The EUR is the base currency; thus, the market participant must use the bid rates (i.e., hit the bid from interbanks). The three-month forward bid rate in this case would be based on the spot bid and the forward points bid and hence would be

The market participant would be selling EUR three months forward at a price of USD 1.16331 per EUR.

The mark-to-market value of a forward contract

1.4 Calculate the mark-to-market value of a forward contract

Forwards contracts C: Mark-to-market value of forward contract

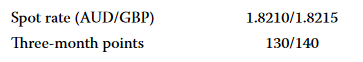

Suppose that a market participant bought GBP 10 million for delivery against the AUD in six months at an “all-in” forward rate of 1.8100 AUD/ GBP. Assume the bid–offer quotes for spot and forward points three months prior to the settlement date are as follows:

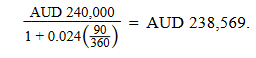

To sell GBP (the base currency in the AUD/GBP quote), we will be calculating the bid side of the market. Hence, the appropriate all-in three-month forward rate to use is 1.8210 + 130/10,000 = 1.8340. This means that the market participant originally bought GBP 10 million at an AUD/ GBP rate of 1.8100 and subsequently sold that amount at a rate of 1.8340. These GBP amounts will net to zero at the settlement date (GBP 10 million both bought and sold), but the AUD amounts will not, because the forward rate has changed. The AUD cash flow at the settlement date will be (1.8340 − 1.8100) × 10,000,000 = +AUD 240,000. Suppose that three-month AUD MRR is 2.40% (annualized).

This result is the mark-to-market value of the original long GBP 10 million six-month forward when it is closed out three months prior to settlement.

Summary:

- Create an offsetting forward position: Match the original forward position (e.g., sell GBP 10 million if originally long GBP 10 million).

- Determine the all-in forward rate: Use the bid/offer side depending on whether the base currency is being sold/bought.

- Calculate the settlement day cash flow: Multiply the contract size by the difference between the original and new forward rates. If the originally long (short) currency appreciates (depreciates), there will be a cash inflow (outflow).

- Calculate the present value of the cash flow: Discount the cash flow at the future settlement date using a rate that matches the currency of the cash flow (the country whose currency is being held).

The factors that affect the bid–offer spread for forward points are the same as those we discussed for spot bid–offer rates: the interbank market liquidity of the underlying currency pair, the size of the transaction, and the relationship between the client and the dealer. For forward bid–offer spreads, we can also add a fourth factor: the term of the forward contract. Generally, the longer the term of the forward contract, the wider the bid–offer spread.

International Parity Conditions

1.5 Explain international parity conditions (covered and uncovered interest rate parity, forward rate parity, purchasing power parity, and the international Fisher effect)

- The key international parity conditions are as follows:

- 1. covered interest rate parity

- 2. uncovered interest rate parity

- 3. forward rate parity

- 4. purchasing power parity

- 5. the international Fisher effect.

Covered and uncovered interest rate parityand forward rate parity

1.6 Explain international parity conditions (covered and uncovered interest rate parity, forward rate parity, purchasing power parity, and the international Fisher effect)

1.7 Describe relations among the international parity conditions

1.8 Evaluate the use of the current spot rate, the forward rate, purchasing power parity, and uncovered interest parity to forecast future spot exchange rates

Covered interest rate parity

We have already discussed covered interest rate parity in our examination of forward exchange rates. Under this parity condition, an investment in a foreign money market instrument that is completely hedged against exchange rate risk should yield exactly the same return as an otherwise identical domestic money market investment.

Uncovered interest rate parity

- 根据 UIP 理论,较高的利率通常伴随着汇率的预期贬值。也就是说,如果一个国家的利率比另一个国家高,虽然投资者可以获得更高的利息收入,但汇率在未来的贬值预期将抵消这部分收益。例如,如果一个国家的利率高出 2%,那么其货币可能会预期贬值 2%,使得投资者的总收益率与低利率国家的收益率相同。假设不发生这种贬值,那么投资者就会持续向高利率国家投资,从而无风险地获得比低利率国家更高的回报。这种套利机会在有效市场中应当不存在,汇率的调整(贬值)会确保不同国家的投资收益率一致。

- UIP 建立在无套利的基础上。如果高利率国家的货币不贬值,投资者可以简单地借入低利率国家的货币,兑换为高利率国家的货币,并获得无风险的高回报。这种套利行为会导致大量资金流入高利率国家,并推高该国货币的汇率。然而,市场通过汇率调整来消除套利机会,这就是为什么 UIP 预测高利率国家的货币会贬值,而不是升值。

- 利率高的国家往往反映出该国经济中存在较大的风险(如通胀上升、经济不确定性增加等),因此投资者需要更高的利率作为补偿。这种经济风险可能会让投资者预期该国的货币在未来贬值,从而影响资本流动。此外,利率较高的国家可能是因为经济不稳定或通胀压力较大,这使得该国货币的购买力在未来降低。投资者虽然能够在短期内获得较高的利率回报,但长期来看,汇率贬值可能会让投资者失去通过高利率获得的收益。

- 短期效应:在利率上升的初期,确实可能会吸引资本流入高利率国家,导致货币短期升值。高利率带来高收益率吸引力,资金流入可能在短期内推动货币升值。长期效应:随着时间推移,市场开始意识到利率差异的背后因素(如通胀、经济不确定性),因此预期该国货币会贬值。汇率逐渐调整,以确保不同国家的收益率差异被汇率变化所抵消。

- 虽然 UIP 是理论上的无套利条件,但在现实中,UIP 经常在短期内未必成立。实际上,高利率货币经常在短期内升值,而不是贬值,这一现象被称为前向溢价之谜(forward premium puzzle)。这意味着投资者在短期内可能通过持有高利率货币获得更高的收益。但在长期,随着汇率预期的调整,汇率贬值通常会弥补利率差异。

According to the uncovered interest rate parity condition, the expected return on an uncovered (i.e., unhedged) foreign currency investment should equal the return on a comparable domestic currency investment. Uncovered interest rate parity states that the change in spot rate over the investment horizon should, on average, equal the differential in interest rates between the two countries. That is, the expected appreciation/depreciation of the exchange rate will just offset the yield differential.

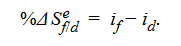

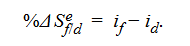

In domestic currency terms, the investment return on an uncovered (or unhedged) foreign-currency-denominated investment is equal to (1 + if)(1 − %Δ Sf/d) − 1. This return can be approximated by ≅ if − % Δ Sf/d. That is %Δ Sef/d = if − id

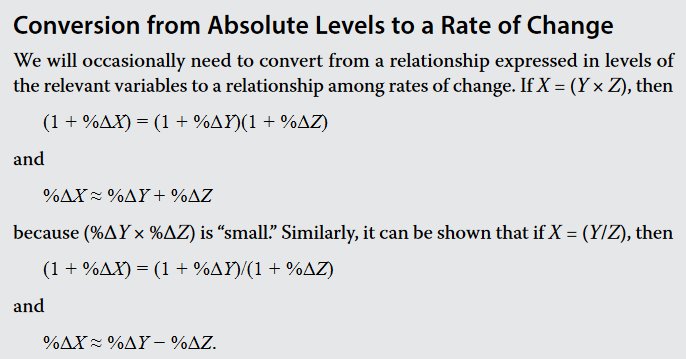

The arbitrage condition that underlies covered interest rate parity (illustrated earlier) can be rearranged to give an expression for the forward premium or discount:

The domestic currency will trade at a forward premium (Ff/d > Sf/d) if, and only if, the foreign risk-free interest rate exceeds the domestic risk-free interest rate (if > id). For the sake of simplicity, we assume that the investment horizon is one year, so that

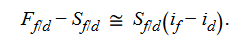

Because the 1 + id denominator will be close to 1, we can approximate the above equation as follows:

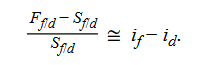

This covered interest rate parity equation can be rearranged to show the forward discount or premium as a percentage of the spot rate:

We have also shown that if uncovered interest rate parity holds, then the expected change in the spot rate is equal to the interest rate differential:

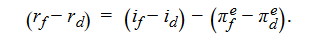

We can link the covered interest rate parity and uncovered interest rate parity equations as follows:

The following equation is Uncovered interest rate parity:

Thus, the forward premium (discount) on a currency, expressed in percentage terms, equals the expected percentage appreciation (depreciation) of the domestic currency (assuming that the uncovered interest rate parity condition holds).

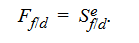

In theory, then, the forward exchange rate will be an unbiased forecast of the future spot exchange rate if both covered and uncovered interest rate parity hold:

This condition is often referred to as forward rate parity.

Purchasing power parity

1.6 Explain international parity conditions (covered and uncovered interest rate parity, forward rate parity, purchasing power parity, and the international Fisher effect)

1.7 Describe relations among the international parity conditions

1.8 Evaluate the use of the current spot rate, the forward rate, purchasing power parity, and uncovered interest parity to forecast future spot exchange rates

- PPP is the relationship between exchange rates and inflation differentials.

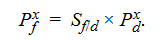

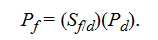

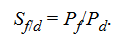

- According to the law of one price, identical goods should trade at the same price across countries when valued in terms of a common currency. The law of one price asserts that the foreign price of good x, Pxf, should equal the exchange rate–adjusted price of the identical good in the domestic country, Pxd:

- The absolute version of PPP simply extends the law of one price to the broad range of goods and services that are consumed in different countries. The broad price level of the foreign country (Pf) should equal the currency-adjusted broad price level in the domestic country (Pd)

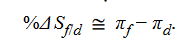

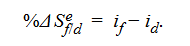

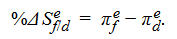

- According to the relative version of PPP, the percentage change in the spot exchange rate (%ΔSf/d) will be completely determined by the difference between the foreign and domestic inflation rates (πf − πd):

- Whereas the relative version of PPP focuses on actual changes in exchange rates being driven by actual differences in national inflation rates, the ex ante version of PPP asserts that the expected changes in the spot exchange rate are entirely driven by expected differences in national inflation rates. Ex ante PPP can be expressed as:

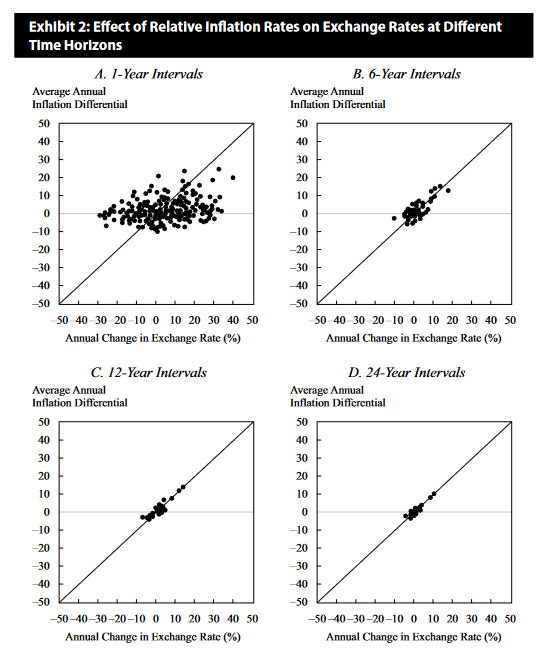

- Studies have found that while over shorter horizons nominal exchange rate movements may appear random, over longer time horizons nominal exchange rates tend to gravitate toward their long-run PPP equilibrium values.

Fisher effect, real interest rate parity, and international Fisher effect

1.6 Explain international parity conditions (covered and uncovered interest rate parity, forward rate parity, purchasing power parity, and the international Fisher effect)

1.7 Describe relations among the international parity conditions

1.8 Evaluate the use of the current spot rate, the forward rate, purchasing power parity, and uncovered interest parity to forecast future spot exchange rates

1.9 Explain approaches to assessing the long-run fair value of an exchange rate

According to what economists call the Fisher effect, one can break down the nominal interest rate (i) in a given country into two parts: (1) the real interest rate (r) in that particular country and (2) the expected inflation rate (πe) in that country: i = r + πe

To relate this concept to exchange rates, we can write the Fisher equation for both the domestic country and a foreign country. If the Fisher effect holds, the nominal interest rates in both countries will equal the sum of their respective real interest rates and expected inflation rates:

To tie this material to our previous work on exchange rates, recall our expression for uncovered interest rate parity:

Recall also the expression for ex ante PPP:

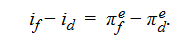

The difference in expected inflation rates equals the expected change in the exchange rate. Combining these two expressions, we derive the following:

The nominal interest rate spread is equal to the difference in expected inflation rates. We can therefore conclude that if uncovered interest rate parity and ex ante PPP hold,

The above proposition that real interest rates will converge to the same level across different markets is known as the real interest rate parity condition.

Finally, if real interest rates are equal across markets, then it also follows that the foreign–domestic nominal yield spread is determined solely by the foreign–domestic expected inflation differential:

This is known as the international Fisher effect. The reader should be aware that some authors refer to uncovered interest rate parity as the “international Fisher effect.”

Summing up

- 1. According to covered interest rate parity, arbitrage ensures that nominal interest rate spreads equal the percentage forward premium (or discount).

- 2. According to uncovered interest rate parity, the expected percentage change of the spot exchange rate should, on average, be reflected in the nominal interest rate spread.

- 3. If both covered and uncovered interest rate parity hold—that is, the nominal yield spread equals both the forward premium (or discount) and the expected percentage change in the spot exchange rate—then the forward exchange rate will be an unbiased predictor of the future spot exchange rate.

- 4. According to the ex ante PPP approach to exchange rate determination, the expected change in the spot exchange rate should equal the expected difference between domestic and foreign inflation rates.

- 5. Assuming the Fisher effect holds in all markets—that is, the nominal interest rate in each market equals the real interest rate plus the expected inflation rate—and also assuming that real interest rates are broadly the same across all markets (real interest rate parity), then the nominal yield spread between domestic and foreign markets will equal the domestic–foreign expected inflation differential, which is the international Fisher effect.

- 6. If ex ante PPP and the international Fisher effect hold, then expected inflation differentials should equal both the expected change in the exchange rate and the nominal interest rate differential. This relationship implies that the expected change in the exchange rate equals the nominal interest rate differential, which is uncovered interest rate parity.

In sum, if all the key international parity conditions held at all times, then the expected percentage change in the spot exchange rate would equal:

- the forward premium or discount (expressed in percentage terms) (both covered and uncovered interest rate parity)

- the nominal yield spread between countries (uncovered interest rate parity)

- the difference between expected national inflation rates (ex ante PPP)

Carry trade

1.10 Describe the carry trade and its relation to uncovered interest rate parity and calculate the profit from a carry trade

Uncovered interest rate parity is one of the most widely tested propositions in international finance. The evidence suggests that uncovered interest rate parity does not hold over short and medium time periods. Studies have generally found that high-yield currencies, on average, have not depreciated and low-yield currencies have not appreciated to the levels predicted by interest rate differentials. These findings underscore the potential profitability of a trading strategy known as the FX carry trade, which involves taking long positions in high-yield currencies and short positions in low-yield currencies.

- Carry trades are leveraged trades (borrow in the funding currency, invest in the high-yield currency), and leverage increases the volatility in the investor’s return on equity.

- Example: Canadian dollars at 1% and earn 9% on an investment in Brazilian reals for one year. To execute the trade to earn 8% from the interest rate differential, the trader will do the following:

- 1. Borrow Canadian dollars at t = 0.

- 2. Sell the dollars and buy Brazilian reals at the spot rate at t = 0.

- 3. Invest in a real-denominated investment at t = 0.

- 4. Liquidate the Brazilian investment at t = 1.

- 5. Sell the reals and buy dollars at the spot rate at t = 1. 6. Pay back the dollar loan.

- During periods of low volatility, carry trades tend to generate positive returns, but they are prone to significant crash risk in turbulent times. Although carry trades have generated positive returns on average in the past, the negative skew and fat tails indicate that carry trades have tended to have more frequent and larger losses than would have been experienced had the return distribution been normal.

The impact of balance of payments flows

1.11 Explain how flows in the balance of payment accounts affect currency exchange rates

- Effects of current account imbalances on exchange rates

- Effects of capital flows

- A country’s balance of payments consists of its current account as well as its capital and financial account.

Current Account Imbalances and the Determination of Exchange Rates

- The flow supply/demand channel

- countries with persistent current account surpluses should see their currencies appreciate over time, and countries with persistent current account deficits should see their currencies depreciate over time.

- The portfolio balance channel

- Current account imbalances shift financial wealth from deficit nations to surplus nations. Countries with trade deficits will finance their trade with increased borrowing. This behavior may lead to shifts in global asset preferences, which in turn could influence the path of exchange rates.

- For example, nations running large current account surpluses versus the United States might find that their holdings of US dollar–denominated assets exceed the amount they desire to hold in a portfolio context. Actions they might take to reduce their dollar holdings to desired levels could then have a profound negative impact on the dollar’s value.

- 经常账户失衡将金融财富从赤字国转移到盈余国。贸易赤字国通过增加借贷来融资,这可能导致全球资产偏好的转变,进而影响汇率。

- 例如,与美国有大量经常账户盈余的国家,可能发现其持有的美元资产超过其投资组合所需。为将美元持有量降至理想水平,他们的减持行动可能对美元价值产生深远的负面影响。

- The debt sustainability channel

- The third mechanism through which current account imbalances can affect exchange rates is the so-called debt sustainability channel. According to this mechanism, there should be some upper limit on the ability of countries to run persistently large current account deficits. If a country runs a large and persistent current account deficit over time, eventually it will experience an untenable rise in debt owed to foreign investors. If such investors believe that the deficit country’s external debt is rising to unsustainable levels, they are likely to reason that a major depreciation of the deficit country’s currency will be required at some point to ensure that the current account deficit narrows significantly and that the external debt stabilizes at a level deemed sustainable.

- The existence of persistent current account imbalances will tend to alter the market’s notion of what exchange rate level represents the true, long-run equilibrium value. For deficit nations, ever-rising net external debt levels as a percentage of GDP should give rise to steady (but not necessarily smooth) downward revisions in market expectations of the currency’s long-run equilibrium value. For surplus countries, ever-rising net external asset levels as a percentage of GDP should give rise to steady upward revisions of the currency’s long-run equilibrium value. Hence, one would expect currency values to move broadly in line with trends in debt and/or asset accumulation.

- 经常账户失衡通过债务可持续性渠道影响汇率:当一国长期存在大量经常账户赤字时,其对外债务将不可持续地上升。若投资者认为该国外债达到了不可持续的水平,他们可能预期该国货币需要大幅贬值,以缩小经常账户赤字并使外债稳定在可持续水平。

- 持续的经常账户失衡会改变市场对汇率长期均衡值的认知。对于赤字国,净外债占GDP比例不断上升,会引发市场对其货币长期均衡价值的持续下调;对于盈余国,净外部资产占GDP比例不断上升,则会引发市场对其货币长期均衡价值的持续上调。因此,货币价值往往与债务或资产积累的趋势大致一致。

Capital flow

1.12 Explain how flows in the balance of payment accounts affect currency exchange rates

- Governments in emerging markets often resist currency appreciation from excessive capital inflows by using capital controls or selling their currency in the FX market.

- Sometimes, capital flows due to interest rate spreads have little impact on the trend in exchange rates.

- 高收益、易通胀的新兴市场国家通过逐步提高国内利率来收紧货币政策,降低通胀预期。持续的高名义收益率差和通胀预期的下降对高收益货币的价值产生上行压力,长期带来套利交易利润。High-yield, inflation-prone emerging market countries tighten monetary policy by gradually raising domestic interest rates to lower inflation expectations. Sustained high nominal yield spreads and declining inflation expectations create upward pressure on the high-yield currency, leading to long-term carry trade profits.

- 政策制定者实施吸引外国投资的政策,如更紧的财政政策、金融市场自由化、减少资本流动限制、私有化和改善营商环境。这些政策使投资者降低持有高收益货币资产的风险溢价,并上调对该国货币长期均衡价值的评估。Policymakers implement policies to attract foreign investment, such as tighter fiscal policies, financial market liberalization, reducing capital flow restrictions, privatization, and improving the business environment. These policies lower the risk premium for holding high-yield currency assets and lead investors to revise upward the currency’s long-run equilibrium value.

- 名义利率差对汇率的影响是渐进的,因为货币政策调整和通胀预期、风险溢价的变化都需要时间。这些因素相互强化,可能导致资本流动和套利交易回报的持续存在。The impact of nominal interest rate spreads on exchange rates is gradual, as monetary policy adjustments and changes in inflation expectations and risk premiums take time. These factors reinforce each other, leading to persistent capital flows and carry trade returns over time.

- Increasing equity prices can also attract foreign capital. Although exchange rates and equity market returns sometimes exhibit positive correlation, the relationship between equity market performance and exchange rates is not stable. Such instability in the correlation between exchange rates and equity markets makes it difficult to form judgments on possible future currency moves based solely on expected equity market performance. Correlations between equity returns and exchange rates are unstable in the short term and tend toward zero in the long run.

Greater financial integration of the world’s capital markets and greater freedom of capital to flow across national borders have increased the importance of global financial flows in determining exchange rates, interest rates, and broad asset price trends. One can cite many examples in which global financial flows either caused or contributed to extremes in exchange rates, interest rates, or asset prices.

In numerous cases, global capital flows have helped fuel boom-like conditions in emerging market economies for a while before, suddenly and often without adequate warning, those flows reversed. The reversals often caused a major economic downturn, sovereign default, a serious banking crisis, and/or significant currency depreciation. Excessive emerging market capital inflows often plant the seeds of a crisis by contributing to:

- 1. an unwarranted appreciation of the emerging market currency,

- 2. a huge buildup in external indebtedness,

- 3. an asset bubble,

- 4. a consumption binge that contributes to explosive growth in domestic credit and/or the current account deficit, or

- 5. an overinvestment in risky projects and questionable activities.

Monetary and FIscal policies

1.13 Explain the potential effects of monetary and fiscal policy on exchange rates

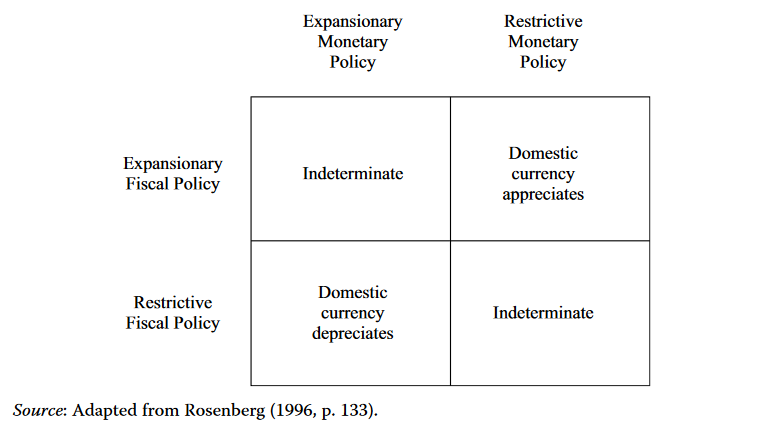

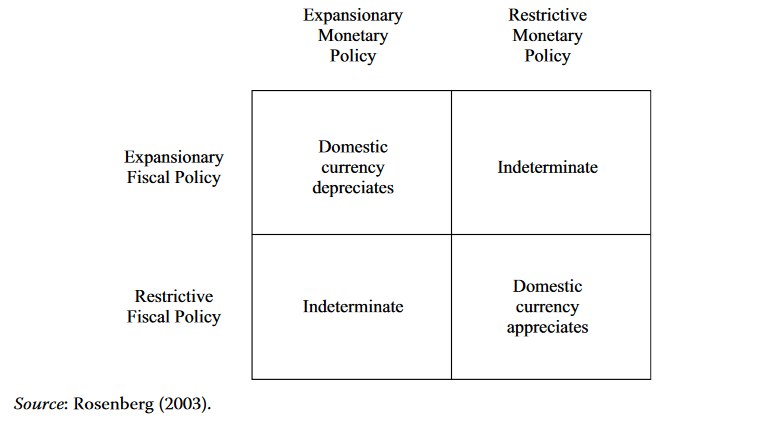

The Mundell–Fleming Model

- Expansionary monetary policy affects growth, in part, by reducing interest rates and thereby increasing investment and consumption spending. Given flexible exchange rates and expansionary monetary policy, downward pressure on domestic interest rates will induce capital to flow to higher-yielding markets, putting downward pressure on the domestic currency. The more responsive capital flows are to interest rate differentials, the greater the depreciation of the currency.

- Expansionary fiscal policy either directly through increased spending or indirectly via lower taxes—typically exerts upward pressure on interest rates because larger budget deficits must be financed. With flexible exchange rates and mobile capital, the rising domestic interest rates will attract capital from lower-yielding markets, putting upward pressure on the domestic currency.

- One of the major shortcomings of the pure monetary approach is the assumption that purchasing power parity holds in both the short and long runs. Because purchasing power parity rarely holds in either the short or medium run, the pure monetary model may not provide a realistic explanation of the impact of monetary forces on the exchange rate.

Monetary Models of Exchange Rate Determination

- To rectify that problem, Dornbusch (1976) constructed a modified monetary model that assumes prices have limited flexibility in the short run but are fully flexible in the long run.

- Long-Run Outcome: An increase in the domestic money supply causes domestic prices to rise proportionally, leading to a depreciation of the currency in line with the pure monetary model.

- Short-Run Dynamics with Sticky Prices: If prices are sticky in the short run, an increase in the money supply lowers interest rates, causing capital outflows and a depreciation of the currency that overshoots its long-run equilibrium value.

- Return to Equilibrium: Over time, as prices and interest rates adjust, the currency appreciates back toward its long-run equilibrium exchange rate as predicted by the monetary model.

The Portfolio Balance Approach

- The Mundell–Fleming model is essentially a short-run model of exchange rate determination. It makes no allowance for the long-term effects of budgetary imbalances that typically arise from sustained fiscal policy actions. The portfolio balance approach to exchange rate determination remedies this limitation. In our previous discussion of the portfolio balance channel, we stated that the currencies of countries with trade deficits will decline over time. We expand that discussion here to more closely examine how exchange rates change over the long term.

- The portfolio balance approach explains how sustained government budget deficits influence exchange rates through investors’ portfolio adjustments. While expansionary fiscal policy may strengthen a currency in the short run by attracting foreign investment, over time, the accumulation of debt can lead to concerns about debt financing and sustainability. These concerns may cause investors to demand higher returns or anticipate currency depreciation, ultimately leading to a decline in the currency’s value. Integrating this approach with the Mundell–Fleming model provides a comprehensive understanding of the short-term and long-term effects of fiscal policy on exchange rates in an environment with high capital mobility.

Exchange rate management: intervention and controls

1.14 Describe objectives of central bank or government intervention and capital controls and describe the effectiveness of intervention and capital controls

Capital flows can be both a blessing and a curse. Capital inflows can be a blessing when they increase domestic investment, thereby increasing a country’s economic growth and asset values. Currency appreciation often follows, which increases returns to global investors. Capital inflows can be a curse, however, if they fuel boom-like conditions, asset price bubbles, and overvaluation of a country’s currency. If capital inflows then reverse, the result may be a major economic downturn, a significant decline in asset prices, and a large depreciation of the currency. Capital inflows often are driven by a combination of “pull” and “push” factors. Pull factors represent a favorable set of developments that encourage foreign capital inflows. These factors may stem from both the public and private sectors. Examples of better economic management by a government include:

- a decrease in inflation and inflation volatility,

- more-flexible exchange rate regimes,

- improved fiscal positions,

- privatization of state-owned entities,

- liberalization of financial markets, and

- lifting of foreign exchange regulations and controls.

the key issue for policymakers is whether intervention and capital controls will actually work in terms of

- (1) preventing currencies from appreciating too strongly,

- (2) reducing the aggregate volume of capital inflows, and

- (3) enabling monetary authorities to pursue independent monetary policies without having to worry about whether changes in policy rates might attract too much capital from overseas.

Warning signs of currency crisis

1.15 Describe warning signs of a currency crisis

Because most crisis episodes have not been adequately anticipated, a great deal of effort has been spent developing early warning systems. One of the problems in developing an early warning system is that views on the underlying causes of currency crises differ greatly. One school of thought contends that currency crises tend to be precipitated by deteriorating economic fundamentals, while a second school contends that currency crises can occur out of the blue, with little evidence of deteriorating fundamentals preceding them.

- If, according to the first school of thought, deteriorating economic fundamentals often precede crises and if those economic fundamentals tend to deteriorate steadily and predictably, then it should be possible to construct an early warning system to anticipate when a currency might be vulnerable.

- The second school of thought argues that, although evidence of deteriorating economic fundamentals might explain a relatively large number of currency collapses, there might be cases in which economies with relatively sound fundamentals have their currencies come under attack. Clearly, these currency crises would be more difficult to predict. Events that are largely unrelated to domestic economic fundamentals include sudden adverse shifts in market sentiment that become self-fulfilling prophecies and contagion from crises in other markets. A crisis may spread to a country when, for example, the country devalues its currency to keep its exports competitive with those of another country that devalued.

Although the variables and methodologies differ from one study to the next, the following conditions were identified in one or more studies:

- 1. Prior to a currency crisis, the capital markets have been liberalized to allow the free flow of capital.

- 2. There are large inflows of foreign capital (relative to GDP) in the period leading up to a crisis, with short-term funding denominated in a foreign currency being particularly problematic.

- 3. Currency crises are often preceded by (and often coincide with) banking crises.

- 4. Countries with fixed or partially fixed exchange rates are more susceptible to currency crises than countries with floating exchange rates.

- 5. Foreign exchange reserves tend to decline precipitously as a crisis approaches.

- 6. In the period leading up to a crisis, the currency has risen substantially relative to its historical mean.

- 7. The ratio of exports to imports (known as “the terms of trade”) often deteriorates before a crisis.

- 8. Broad money growth and the ratio of M2 (a measure of money supply) to bank reserves tend to rise prior to a crisis.

- 9. Inflation tends to be significantly higher in pre-crisis periods compared with tranquil periods.

These factors are usually interrelated and often feed off one another. For example, in the case of the first five factors, large inflows of foreign capital occur because the financial markets have been liberalized and domestic banks have borrowed abroad. If the borrowing is denominated in a foreign currency and the domestic currency initially depreciates, the bank may have trouble servicing its debt, especially when the debt is of shorter maturity. This scenario may cause foreign investors to withdraw capital and speculators to short the currency, with their actions causing further declines in the currency. If the government is trying to maintain the currency’s value, it could increase interest rates to stem capital outflows or defend its currency using direct intervention. The former action may worsen the banking industry’s condition and slow down the economy. In the latter approach, the government will have to spend down its foreign currency reserves to buy its own currency in the foreign exchange markets. If the government appears unwilling or unable to defend its currency, then capital outflows and speculative attacks will increase. The fifth through seventh factors are related because an overvalued currency may make the country’s exports less competitive. With fewer exports, the country is not able to earn as much foreign currency. Other interrelationships occur because these factors often coincide.

Models cannot predict every crisis, and they sometimes generate false alarms. Nevertheless, an early warning system can be useful in assessing and preparing for potential negative tail risks. As with any analytical tool, the implementation of an early warning system requires integration with other analysis and judgment that cannot be easily quantified or conceptualized.

Learning Module 2: Economic Growth

- Compare factors favoring and limiting economic growth in developed and developing economies

- Describe the relation between the long-run rate of stock market appreciation and the sustainable growth rate of the economy

- Explain why potential GDP and its growth rate matter for equity and fixed income investors

- Contrast capital deepening investment and technological progress and explain how each affects economic growth and labor productivity

- Demonstrate forecasting potential GDP based on growth accounting relations

- Explain how natural resources affect economic growth and evaluate the argument that limited availability of natural resources constrains economic growth

- Explain how demographics, immigration, and labor force participation affect the rate and sustainability of economic growth

- Explain how investment in physical capital, human capital, and technological development affects economic growth

- Compare classical growth theory, neoclassical growth theory, and endogenous growth theory

- Explain and evaluate convergence hypotheses

- Describe the economic rationale for governments to provide incentives to private investment in technology and knowledge

- Describe the expected impact of removing trade barriers on capital investment and profits, employment and wages, and growth in the economies involved

GDP and per capita GDP are the best indicators economists have for measuring a country’s standard of living and its level of economic development. Economic growth is calculated as the annual percentage change in real GDP or in real per capita GDP. Growth in real GDP measures how rapidly the total economy is expanding. Real per capita GDP reflects the average standard of living in each countryessentially the average level of material well-being. Growth in real GDP per capita (i.e., real GDP growing faster than the population) implies a rising standard of living.

Factors favoring and limiting economic growth in developed and developing economies

2.1 Compare factors favoring and limiting economic growth in developed and developing economies

- Savings and Investment

- A country amasses capital from both private and public sector investments. It is noteworthy that Investments are usually made from savings. Increasing the investment rate in developing countries is difficult because there is a lower disposable income for meaningful savings than in developed countries.

- Financial Markets and Intermediaries

- Any financial market (such as banks)’s function is to direct savers’ funds toward viable projects leading to economic growth. The financial market achieves this by:

- Filtering those seeking funding while supervising those who have acquired funds to ensure that they indulge in projects that generate risk-adjusted returns.Promote savings and risk-taking by constructing viable investment instruments.Reduction of credit blocks that companies must surmount in financing capital investments.

- Any financial market (such as banks)’s function is to direct savers’ funds toward viable projects leading to economic growth. The financial market achieves this by:

- Political Stability, Rule of Law, and Property Rights

- Property rights are legal structures that protect private and intellectual property. In developed countries, the legal system is well established to protect these rights. The same might not be said about most developing countries.Political instability occasioned by such occurrences as war increases investment risk and cripples foreign investment and economic growth. Political instability is much more experienced in developing countries than in developed countries.

- Education and Health Care Systems

- In most developing countries, the education system has not been well established compared with developed countries. Therefore, a large portion of the labor force is illiterate, with a small portion having the capacity to use the ever-changing technology. Moreover, there exists a brain drain in developing countries. Highly skilled citizens leave their developing countries for developed countries, further depriving their countries of the expertise they need for development. Therefore, improving the education system through formal schooling and informal job training works best for the economy.Due to the unavailability of top-grade health amenities in developing countries, the life expectancy in such countries is lower than in developed countries. For instance, diseases are more prevalent in African countries, worsened by the HIV/AIDS epidemic.

- Free Trade and Unrestricted Capital Flows

- An open economy is where capital and trade flow freely. Since foreign investment is a source of funds, it can increase income, savings, and investments. Therefore, developing countries would benefit from the formulation of policies that attract external investment. Such policies include the removal of higher trade tariffs on imports and easing restrictions on all foreign investments. On the other hand, free trade boosts a country’s economy by availing more goods and services at lower prices.

- Tax and Regulatory Systems

- Limited tax regulations catalyze business activities and the entry of new companies into a market, thus increasing the productivity levels of a country. In most developing countries, a tax regulatory system discourages foreign investors, worsening the state of their economy.

Developing countries differ significantly from developed countries in terms of their institutional structure and their legal and political environments. Lack of appropriate institutions and poor legal and political environments restrain growth in the developing economies and partially explain why these countries are poor and experience slow growth. Factors limiting growth include the following:

- Low rates of saving and investment

- Poorly developed financial markets

- Weak, or even corrupt, legal systems and failure to enforce laws

- Lack of property rights and political instability

- Poor public education and health services

- Tax and regulatory policies discouraging entrepreneurship

- Restrictions on international trade and flows of capital

- In addition to these institutional restraints, as we will see later, growth in developing countries may be limited by a lack of physical, human, and public capital, as well as little or no innovation.

Why potential growth matters to investors

2.2 Describe the relation between the long-run rate of stock market appreciation and the sustainable growth rate of the economy

2.3 Explain why potential GDP and its growth rate matter for equity and fixed income investors

The impact on equity market

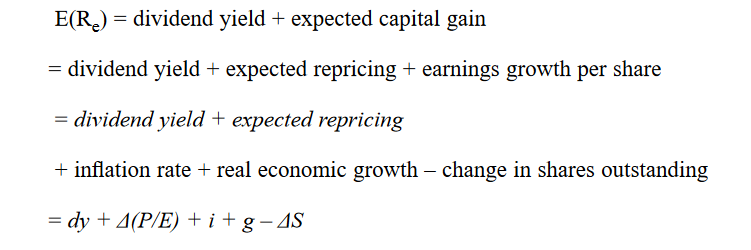

- Grinold-Kroner (2002) decomposition of the return to equity (ROE)

- Over time, the dividend yield (dy) has remained relatively stable and serves as a significant contributor to equity market returns. The repricing term, Δ(P/E), reflects changes in P/E ratios. Higher GDP growth rates often correlate with rising P/E ratios, as investors view the economy as less risky and are willing to pay more for earnings. However, the main impact of this term is the volatility of P/E ratios throughout market cycles.

- Earnings growth per share, influenced by inflation, real economic growth, and changes in shares traded, is the key channel through which economic growth affects equity returns. When the number of shares remains constant, real economic growth leads to higher equity returns. However, empirical evidence on the direct link between economic growth and equity returns is mixed, suggesting that the dilution effect, represented by ΔS (change in shares outstanding), is crucial in determining expected returns. This dilution varies across countries due to factors like economic development and financial market sophistication.

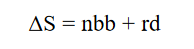

- The divergence between economic growth and equity returns arises for two reasons. First, publicly traded companies either buy back shares, increasing returns by reducing shares outstanding, or issue new shares, diluting returns. The net buybacks (nbb) capture the balance between these activities at the national level. Second, a portion of economic growth stems from small- and medium-sized firms not publicly traded, leading to a divergence between overall economic growth and earnings growth of listed companies. This is known as the relative dynamism of the economy (rd). Therefore, the ΔS dilution effect reflects both net buybacks and the impact of unlisted firms.

The impact on fixed-income

- A higher rate of potential GDP growth improves the general credit quality of fixed-income securities. Credit rating agencies use the growth rate of potential GDP in evaluating the credit risk of sovereign debt. All else equal, slower estimated potential GDP growth raises the perceived risk of these bonds.

- Monetary policy decisions are affected by the difference between an economy’s estimated potential output and its actual operating level (referred to as the output gap) and by the growth of actual GDP relative to the long-term sustainable growth rate. Thus, fixed-income investors need to closely monitor the output gap and growth rates of actual and potential GDP to assess the likelihood of a change in central bank policy.

- Government budget deficits typically increase during recessions and decrease during expansions. In examining fiscal policy, actual fiscal positions are often judged relative to structural or cyclically adjusted deficits, a theoretical budgetary balance that would exist if the economy were operating at its potential GDP.

Production function and growth accounting

2.4 Contrast capital deepening investment and technological progress and explain how each affects economic growth and labor productivity

2.5 Demonstrate forecasting potential GDP based on growth accounting relations

Production Function

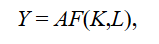

A production function is a model of the quantitative link between the inputs (factors of production), technology, and output. A two-factor aggregate production function with labor and capital as the inputs can be represented as

where Y denotes the level of aggregate output in the economy, L is the quantity of labor or number of workers or hours worked in the economy, and K is an estimate of the capital services provided by the stock of equipment and structures used to produce goods and services. The function F( ) embodies the fact that capital and labor can be used in various combinations to produce output.

In the production function above, A is a multiplicative scale factor referred to as total factor productivity (TFP). Note that an increase in TFP implies a proportionate increase in output for any combination of inputs. Hence, TFP reflects the general level of productivity or technology in the economy. The state of technology embodies the cumulative effects of scientific advances, applied research and development, improvements in management methods, and ways of organizing production that raise the productive capacity of factories and offices.

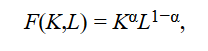

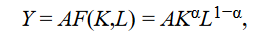

To obtain concrete results, it is useful to use a specific functional form for the production function. The Cobb–Douglas production function, given by:

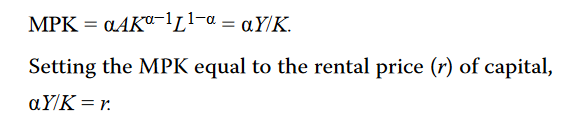

The parameter α determines the shares of output (factor shares) paid by companies to capital and labor and is assumed to have a value between 0 and 1. The reason for this follows from basic microeconomics. In a competitive economy, factors of production are paid their marginal product. Profit maximization requires that the marginal product of capital equal the rental price of capital and the marginal product of labor equal the (real) wage rate. In the case of capital, the marginal product of capital (MPK) for the Cobb–Douglas production function is: (The marginal product of capital is simply the derivative of output with respect to capital. This relationship can be approximated as ΔY/ΔK ≈ [A(K + ΔK)αL1−α − AKαL1−α]/ΔK ≈ [AαKα−1ΔKL1−α]/ΔK = AαKα−1L1-α = αY/K. The approximation becomes exact for very small increments, ΔK.)

If we solve this equation for α, we find that it equals the ratio of capital income, rK, to output or GDP, Y. Thus, α is the share of GDP paid out to the suppliers of capital. A similar calculation shows that 1 − α is the share of income paid to labor. This result is important because it is easy to estimate α for an economy by simply looking at capital’s share of income in the national income accounts.

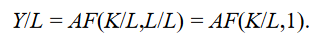

The Cobb–Douglas production function exhibits two important properties that explain the relationship between the inputs and the output. First, the Cobb–Douglas production function exhibits constant returns to scale. This means that if all the inputs into the production process are increased by the same percentage, then output rises by that percentage. Under the assumption of constant returns to scale, we can modify the production function F(K,L) =KαL1−α and examine the determinants of the quantity of output per worker. Multiplying the production function by 1/L gives:

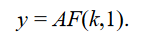

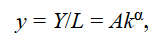

Defining y = Y/L as the output per worker or (average) labor productivity and k = K/L as the capital-to-labor ratio, the expression becomes:

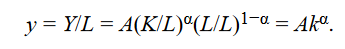

Specifying the Cobb–Douglas production function in output per worker terms, where again lower case letters denote variables measured on a per capita basis, we get

This equation tells us that the amount of goods a worker can produce (labor productivity) depends on the amount of capital available for each worker (capital-to-labor ratio), technology or TFP, and the share of capital in GDP (α). It is important to note that this equation contains two different measures of productivity or efficiency. Labor productivity measures the output produced by a unit of labor, dividing the output (GDP) by the labor input used to produce that output (y = Y/L). TFP is a scale factor that multiplies the impact of the capital and labor inputs.

A second important property of the model is the relation between an individual input and the level of output produced. The Cobb–Douglas production function exhibits diminishing marginal productivity with respect to each individual input. Marginal productivity is the extra output produced from a one-unit increase in an input keeping the other inputs unchanged. It applies to any input as long as the other inputs are held constant. For example, if we have a factory of a fixed size and we add more workers to the factory, the marginal productivity of labor measures how much additional output each additional worker will produce. Diminishing marginal productivity means that at some point, the extra output obtained from each additional unit of the input will decline. To continue our example, if we hire more workers at the existing factory (fixed capital input in this case), each additional worker adds less to output than the previously hired worker does, and average labor productivity (y) falls.

The significance of diminishing marginal returns in the Cobb–Douglas production function depends on the value of α. A value of α close to zero means diminishing marginal returns to capital are very significant and the extra output made possible by additional capital declines quickly as capital increases. In contrast, a value of α close to one means that the next unit of capital increases output almost as much as the previous unit of capital. In this case, diminishing marginal returns still occur but the impact is relatively small. Note that the exponents on the K and L variables in the Cobb–Douglas production function sum to one, indicating constant returns to scale—that is, there are no diminishing marginal returns if both inputs are increased proportionately.

Growth Accounting

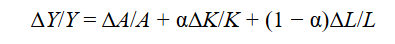

Since the publication of Solow’s seminal work (Solow 1957), growth accounting has been used to analyze the performance of economies. The growth accounting equation is essentially the production function written in the form of growth rates. It starts with the Cobb–Douglas production function and decomposes the percentage change in output into components attributable to capital, labor, and technology:

The growth accounting equation states that output growth equals the sum of the rate of technological change, α times the growth rate of capital, and (1 − α) times the growth rate of labor. Here, α represents the elasticity of output with respect to capital, while (1 − α) represents the elasticity with respect to labor. In the Cobb-Douglas production function, these exponents also represent the income shares for capital and labor. Unspecified inputs, such as natural resources, are included in the total factor productivity (TFP) term.

In developed countries, data on output, capital, labor, and the elasticities of these factors are widely available. Technological change, or TFP, must be estimated since it is not directly observable. The elasticities of capital and labor, which are the income shares of these factors, can be derived from national GDP accounts. For instance, in the U.S., labor’s share is about 0.7, and capital’s share is 0.3. This implies that a 1% increase in labor contributes more to GDP growth than a similar increase in capital. For example, with capital’s share at 0.3, a 1% rise in capital raises output by only 0.3%, while an equivalent rise in labor boosts output by 0.7%.

The growth accounting equation serves several purposes. First, Solow used it to estimate the role of technological progress in economic growth by solving for TFP as the residual. This residual captures output growth unexplained by capital and labor inputs and represents technological advancement.

Second, the equation helps quantify the contributions of different factors to long-term economic growth, answering questions about the importance of labor, capital deepening, and TFP. It can be extended to account for variations in labor and capital, such as human and knowledge capital, and can assess the quality of these inputs.

Lastly, the equation is used to estimate potential output. Potential GDP is calculated using trend data for labor, capital, and an estimate of α. Estimating TFP growth is challenging, as it is treated as exogenous and calculated as the residual growth after accounting for inputs. Expanding the production function to include additional inputs requires adjusting the residual calculation to account for their weighted growth rates. Standard methods estimate TFP using time-series models.

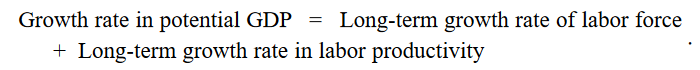

An alternative approach is the labor productivity growth accounting equation, which simplifies the process by modeling potential GDP as a function of labor input and labor productivity. This method avoids the need to estimate capital inputs and TFP separately, but it can obscure the distinctions between capital deepening and TFP, making long-term predictions harder. Under this method, potential GDP is estimated using labor productivity growth.

Thus, potential GDP growth is a combination of the long-term growth rate of the labor force and the long-term growth rate of labor productivity. If the labor force is growing at 1% per year and productivity per worker is rising at 2% per year, then potential GDP is rising at 3% per year.

Extending the Production Function

As a simplification, the production function in Equation 1 focused on only the labor and capital inputs. A more complete specification of the production function expands the list of inputs to include the following:

- Raw materials: natural resources such as oil, lumber, and available land (N)

- Quantity of labor: the number of workers in the country (L)

- Human capital: education and skill level of these workers (H)

- Information, computer, and telecommunications (ICT) capital: computer hardware, software, and communication equipment (KIT)

- Non-ICT capital: transport equipment, metal products and plant machinery other than computer hardware and communications equipment, and non-residential buildings and other structures (KNT)

- Public capital: infrastructure owned and provided by the government (KP)

- Technological knowledge: the production methods used to con

The expanded production function is expressed mathematically as

Y = AF(N,L,H,KIT,KNT,KP).

The impact of each of these inputs on economic growth is addressed in the following sections.

Capital Deepening vs. Technological Progress

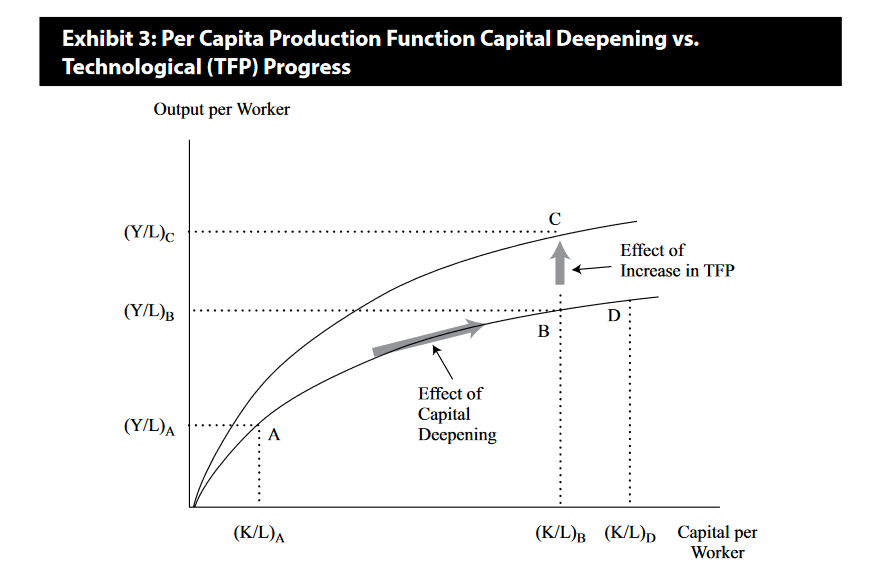

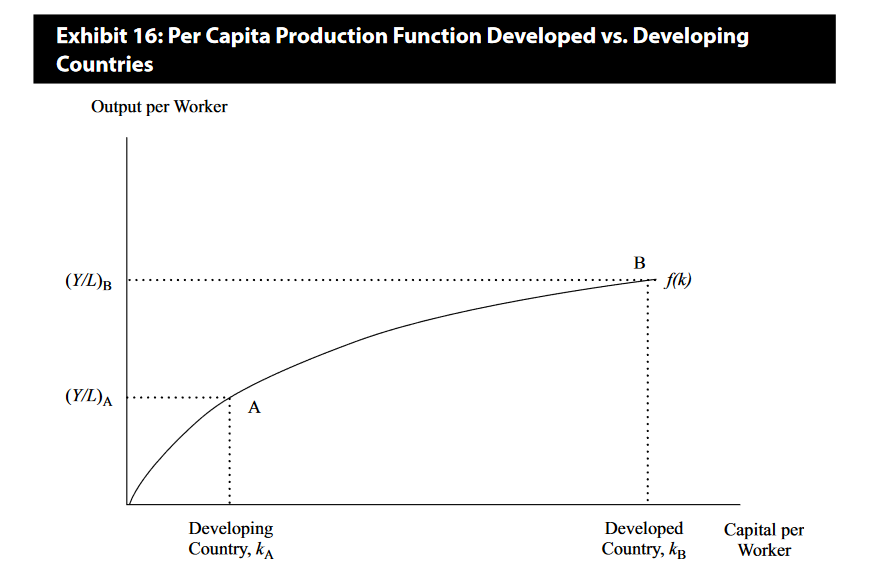

The property of diminishing marginal returns plays an important role in assessing the contribution of capital and technology to economic growth. Exhibit 3 shows the relationship between per capita output and the capital-to-labor ratio. It shows that adding more and more capital to a fixed number of workers increases per capita output but at a decreasing rate. Looking at Exhibit 3 and Example 3, we can think of growth in per capita output coming from two sources: capital deepening and an improvement in technology, often referred to as technological progress.

In summary, sustained growth in per capita output requires progress in TFP (technological progress). The neoclassical model’s stark implication that more-rapid capital accumulation —that is, higher rates of investment—cannot result in a permanently higher rate of per capita growth. At the point at which the marginal product of capital equals its marginal cost, profit maximizing producers will stop adding capital

Natural resources

There are two categories of natural resources:

- Renewable resources are those that can be replenished, such as a forest. For example, if a tree is cut, a seedling can be planted and a new forest harvested in the future.

- Non-renewable resources are finite resources that are depleted once they are consumed. Oil and coal are examples.

Even though access to natural resources (e.g., via trade) is important, ownership and production of natural resources is not necessary for a country to achieve a high level of income. For some countries, the presence of natural resources may even restrain growth, resulting in a “resource curse.” There are two main reasons why this may occur.

- First, countries rich in natural resources may fail to develop the economic institutions necessary for growth.

- Second, countries rich in resources may suffer the Dutch disease, where currency appreciation driven by strong export demand for resources makes other segments of the economy, in particular manufacturing, globally uncompetitive.

Labor supply

2.6 Explain how demographics, immigration, and labor force participation affect the rate and sustainability of economic growth

The labor force is defined as the working age population (ages 16 to 64) that is either employed or available for work but not working (i.e., unemployed). Thus, growth in the labor input depends on four factors: population growth, labor force participation, net migration, and average hours worked.

- Population Growth

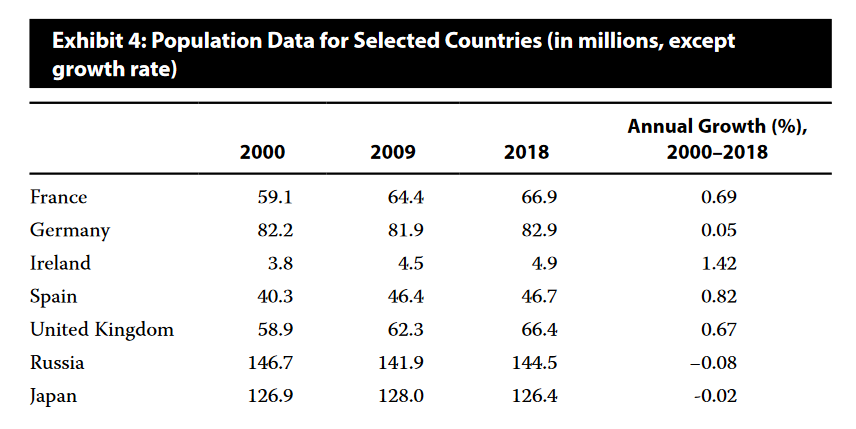

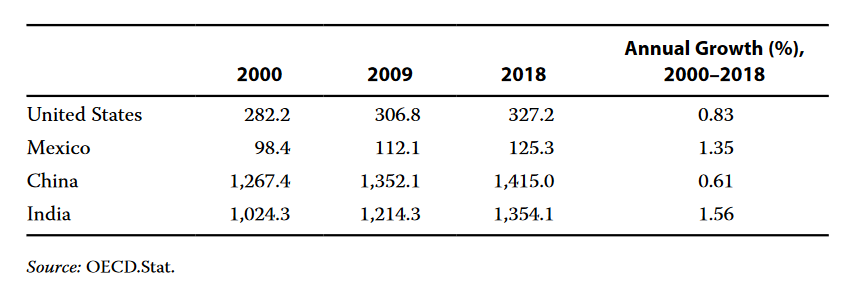

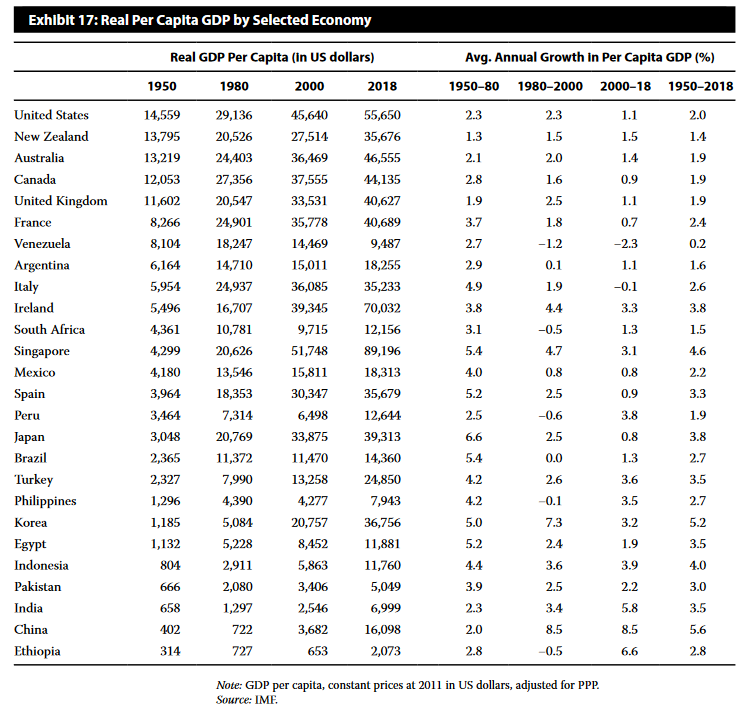

- Long-term projections of the labor supply are largely determined by the growth of the working age population. Population growth is determined by fertility rates and mortality rates. Population growth rates are significantly lower in the developed countries than in the developing countries. As a result, there is an ongoing decline in the developed countries’ share of the world’s population. Note that although population growth may increase the growth rate of the overall economy, it has no impact on the rate of increase in per capita GDP.

- The age mix of the population is also important. The percentage of the population over the age of 65 and the percentage below the age of 16 are key considerations. Some of the developed countries, especially European countries, Japan, and South Korea, are facing a growing demographic burden as the portion of non-working elders (over 65) grows as a share of the population. In contrast, growth in many developing countries will receive a demographic boost as the fraction of the population below the age of 16 begins to decline. Interestingly, China is similar to the advanced economies, with a growing proportion of the population over age 65.

- Labor Force Participation

- In the short run, the labor force growth rate may differ from population growth because of changes in the participation rate. The labor force participation rate is defined as the percentage of the working age population in the labor force. It has trended upward in most countries over the last few decades because of rising participation rates among women. In contrast to population, an increase in the participation rate may raise the growth of per capita GDP. In many southern European countries, such as Greece and Italy, the participation rate among women is well below the rates in the United States and northern European countries (see Exhibit 5). Thus, rising participation rates among women in these countries could increase growth in the labor force and in potential GDP. This has been the case for Spain, where the female labor force participation rate rose from 52.0% in 2000 to 67.9% in 2018. It should be noted, however, that rising or falling labor force participation is likely to represent a transition to a new higher or lower level of participation rather than a truly permanent rate of change. Thus, although trends in participation may contribute to or detract from potential growth for substantial periods, one should be cautious in extrapolating such trends indefinitely.

- Net Migration

- Another factor increasing economic and population growth, especially among the developed countries, is immigration. Heightened immigration is a possible solution to the slowing labor force growth being experienced by many developed countries with low birthrates within the native population. The growth rate of the labor force in Ireland, Spain, the United Kingdom, and the United States has increased between 2000 and 2010 because of immigration, although it slowed substantially in the 2010–2018 period. Focusing on the decade starting in 2000, Exhibit 4 shows the population growth rates for Ireland and Spain at 1.71% and 1.35%, respectively. The population growth rates were well above the population growth rates in other European countries. As shown in Exhibit 6, this is because of the impact of immigration. The open-border policies of both countries led to a significant population of immigrants that contributed to a large increase in labor input for both countries. As a consequence, both countries experienced GDP growth above the European average during this period (see Exhibit 1).

- Average Hours Worked

- The contribution of labor to overall output is also affected by changes in the average hours worked per worker. Average hours worked is highly sensitive to the business cycle. The long-term trend in average hours worked, however, has been toward a shorter work week in the advanced countries. This development is the result of legislation, collective bargaining agreements, the growth of part-time and temporary work, and the impact of both the “wealth effect” and high tax rates on labor income, which cause workers in high-income countries to value leisure time relatively more highly than labor income.

- Exhibit 7 provides data on average hours worked per year per person in the labor force for selected years since 1995. For most countries, the average number of hours worked per year has been declining. There is also a significant difference in hours worked across countries. In 2018, average hours worked per year in South Korea, at 1,993 hours, were 46.1% more than the 1,363 average hours worked per year in Germany. The increase in female labor force participation rates may be contributing to the shorter average workweek because female workers disproportionately take on part-time, rather than full-time, jobs.

- Labor Quality: Human Capital

- In addition to the quantity of labor, the quality of the labor force is an important source of growth for an economy. Human capital is the accumulated knowledge and skills that workers acquire from education, training, or life experience. In general, better-educated and more-skilled workers will be more productive and more adaptable to changes in technology or other shifts in market demand and supply.

- An economy’s human capital is increased through investment in education and on-the-job training. Like physical capital, investment in education is costly, but studies show that there is a significant return on that investment. That is, people with more education earn higher wages. In addition, education may also have a spillover or externality impact. Increasing the educational level of one person raises not only the output of that person but also the output of those around that person. The spillover effect operates through the link between education and advances in technology. Education not only improves the quality of the labor force, and thus the stock of human capital, but also encourages growth through innovation. Importantly, increased education, obtained both formally and via on-the-job training, could result in a permanent increase in the growth rate of an economy if the more educated workforce results in more innovations and a faster rate of technological progress. Investment in the population’s health is also a major contributor to human capital, especially in developing countries.

ICT, Non-ICT, and technology and public infrastructure

2.7 Explain how investment in physical capital, human capital, and technological development affects economic growth

ICT and Non ICT

- These studies suggest that capital spending could be separated into two categories.

- ICT: Spending on information, computers, and telecommunications equipment (ICT investment), The IT sector has grown very rapidly and has made a significant contribution to increasing the rate of economic and productivity growth. The greater use of IT equipment in various industries has resulted in network externalities. Computers allow people to interconnect through the internet and by email, enabling them to work more productively. The more people in the network, the greater the potential productivity gains.

- Non ICT: Non-ICT capital spending includes non-residential construction, transport equipment, and machinery.

- High levels of capital spending for Non ICT should eventually result in capital deepening and thus have less impact on potential GDP growth.

- In contrast, a growing share of ICT investments in the economy, through their externality impacts, may actually boost the growth rate of potential GDP.

Technology

- The most important factor affecting growth of per capita GDP is technology, especially in developed countries.

- Technological change can be embodied in human capital (knowledge, organization, information, and experience base) and/or in new machinery, equipment, and software. Therefore, high rates of investment are important, especially investment in ICT goods.

- Countries can also innovate through expenditures, both public and private, on research and development (R&D). Expenditures on R&D and the number of patents issued, although not directly measuring innovation, provide some useful insight into innovative performance.

Public Infrastructure

- The final expansion of the definition of the capital input is public infrastructure investment.

- Roads, bridges, municipal water, dams and, in some countries, electric grids are all examples of public capital.

- They have few substitutes and are largely complements to the production of private sector goods and services.

- Infrastructure investment is an important source of productivity growth and should be included as an input in the production function.

Summary of economic growth determinants

The factors of production include

- human capital

- ICT and non-ICT capital (the supply of non-ICT and ICT capital)

- public capital (also known as public Infrastructure)

- labor (the quantity and quality of labor)

- natural resources (aw materials)

- technological knowledge

Theories of growth

2.8 Compare classical growth theory, neoclassical growth theory, and endogenous growth theory

Classical growth theory was developed by Thomas Malthus in his 1798 publication Essay on the Principle of Population.

- The classical model predicts that in the long run, the adoption of new technology results in a larger but not richer population. Thus, the standard of living is constant over time even with technological progress, and there is no growth in per capita output

- The prediction from the Malthusian model failed for two reasons:

- 1. The link between per capita income and population broke down. In fact, as the growth of per capita income increased, population growth slowed rather than accelerating as predicted by the classical growth model.

- 2. Growth in per capita income has been possible because technological progress has been rapid enough to more than offset the impact of diminishing marginal returns.

- Because the classical model’s pessimistic prediction never materialized, economists changed the focus of the analysis away from labor to capital and to the neoclassical model.

Robert Solow devised the mainstream neoclassical theory of growth in the 1950s (Solow 1957). The heart of this theory is the Cobb–Douglas production function discussed earlier. As before, the potential output of the economy is given by

where K is the stock of capital, L is the labor input, and A is total factor productivity. In the neoclassical model, both capital and labor are variable inputs each subject to diminishing marginal productivity.

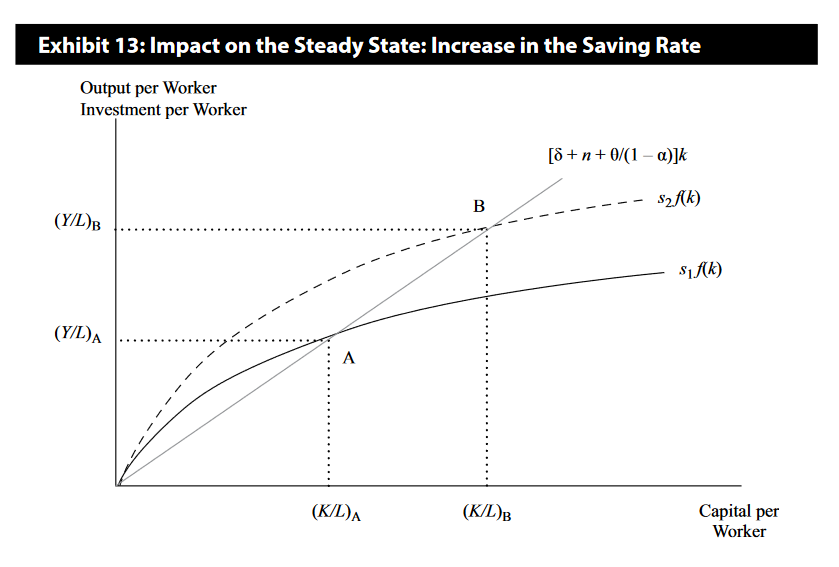

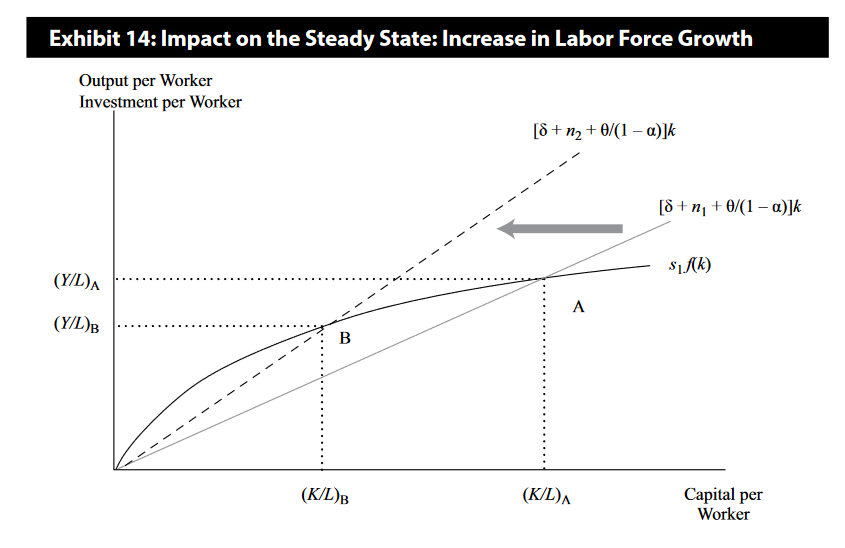

The objective of the neoclassical growth model is to determine the long-run growth rate of output per capita and relate it to (a) the savings/investment rate, (b) the rate of technological change, and (c) population growth.

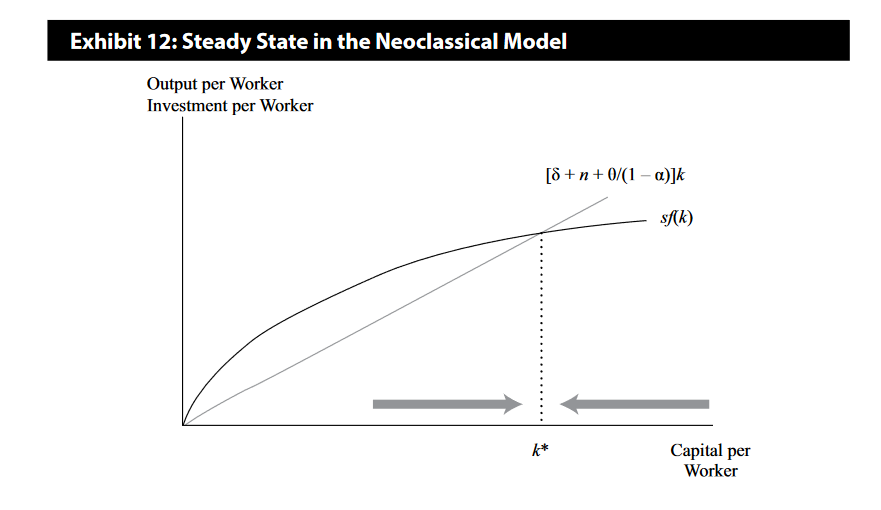

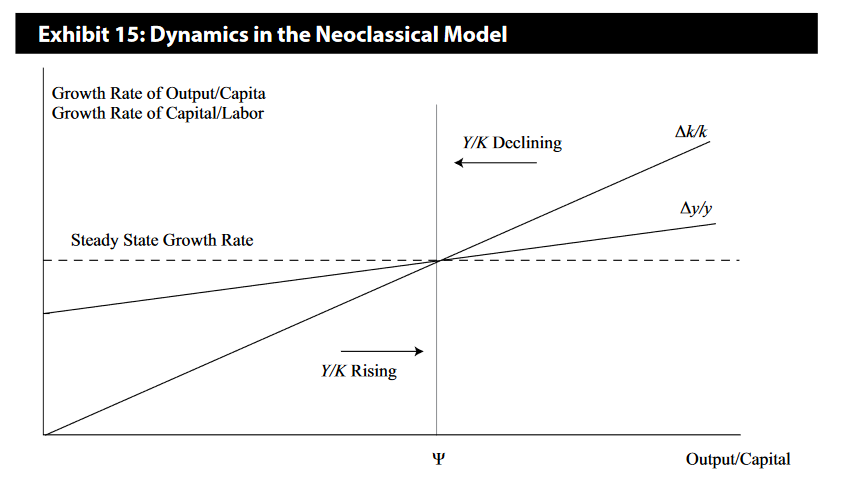

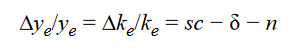

Balanced or Steady-State Rate of Growth

As with most economic models, the neoclassical growth model attempts to find the equilibrium position toward which the economy will move. In the case of the Solow model, this equilibrium is the balanced or steady-state rate of growth that occurs when the output-to-capital ratio is constant. Growth is balanced in the sense that capital per worker and output per worker grow at the same rate. We begin the analysis by using the per capita version of the Cobb–Douglas production function given earlier:

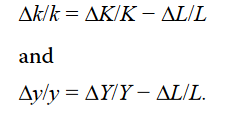

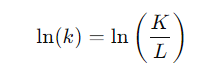

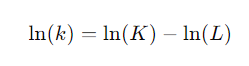

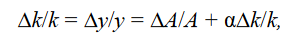

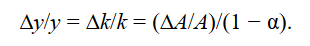

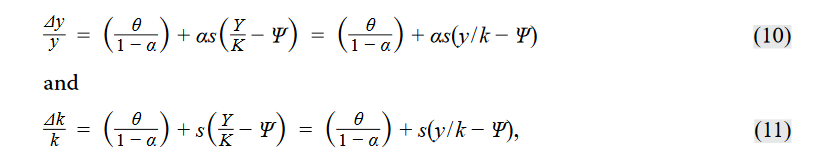

where k = K/L (that is capital-to-labor ratio (k)). Using their definitions, the rates of change of capital per worker and output per worker are given by

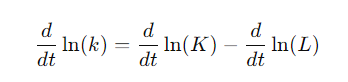

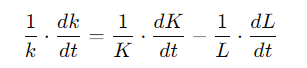

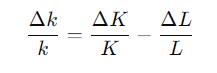

Derivation: We take log transfer for k = K/L, and take the derivation of time for both side

From the production function, the growth rate of output per worker is also equal to

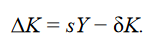

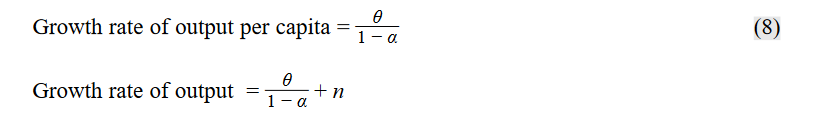

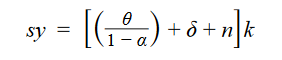

The physical capital stock in an economy will increase because of gross investment (I) and decline because of depreciation. In a closed economy, investment must be funded by domestic saving. Letting s be the fraction of income (Y) that is saved, gross investment is given by I = sY. Assuming the physical capital stock depreciates at a constant rate, δ, the change in the physical capital stock is given by

Subtracting labor supply growth, ΔL/L ≡ n, and rearranging gives

In the steady state, the growth rate of capital per worker is equal to the growth rate of output per worker. Thus, (From eqution (6))

from which we get